A growing narrative shaping the natural gas futures market centers on the anticipated surge in electricity demand driven by AI advancements. It’s clear why this perspective is gaining traction. AI data centers, some projected to consume as much electricity as entire cities, are set to significantly increase power demand. Much of this demand will likely be met by natural gas-fired power plants, which remain critical to ensuring grid reliability.

We agree with this AI-driven demand thesis and recognize the transformative impact data center demand could have on the natural gas market. However, our bullish stance on natural gas is rooted in a different driver: the rapid expansion of LNG export capacity, which we think is a more immediate and impactful aspect of the demand picture.

LNG facilities consume large volumes of natural gas to produce liquefied natural gas for export, enabling transportation to higher-priced international markets. As new terminals come online, domestic demand increases to supply these facilities, which send LNG to regions like Asia and Europe, where prices command a significant premium over Henry Hub.

This highly profitable regional arbitrage creates a consistent source of domestic natural gas demand to supply LNG export facilities, though this demand has historically been constrained by the limited capacity of these facilities. This constraint is now easing, with LNG export capacity set to double by 12 Bcf per day over the next three years.

We think that recent trends and developments suggest the projected 12 Bcf/d increase in LNG capacity is significantly underestimated, and that capacity will come online faster and in greater volumes than currently anticipated.

Driving our view is the example of Plaquemines LNG, which reached first production just 30 months after its final investment decision (FID), despite COVID-related supply chain challenges and regulatory hurdles under the Biden administration. This success highlights the potential for faster development timelines, which is critical when considering the additional 22 Bcf/d of approved LNG export capacity awaiting FID. Under a Trump administration aiming to accelerate LNG infrastructure expansion, this could usher in a ‘golden era’ for LNG exporters.

Combining the 12 Bcf/d of LNG capacity currently under construction with the 22 Bcf/d of approved projects and factoring in additional demand from AI-driven data center growth, we see a runway for U.S. natural gas demand increasing by over 40 Bcf/d through the end of the decade. For context, U.S. gas production today is approximately 105 Bcf/d, and it took 14 years of shale-driven growth to expand from 65 Bcf/d to the current level. Meeting an additional 40 Bcf/d of demand will require significant investment and operational expansion. The critical question is what price will it take to incentivize this growth?

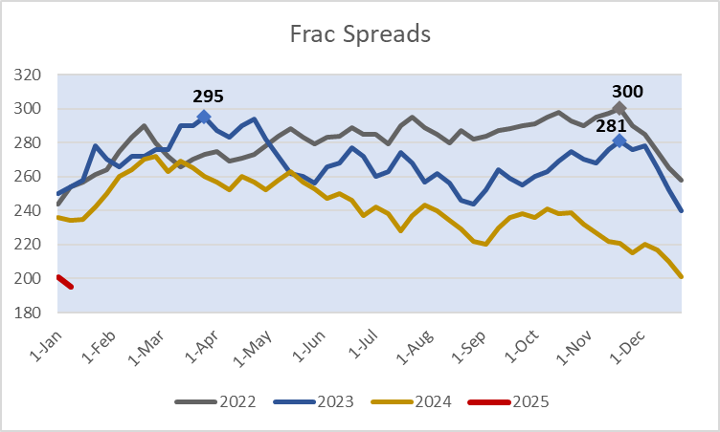

Declining year over year frac spreads, gas rigs, and flat to lower gas production indicate that the current pricing environment is too low.

Recent comments from prominent natural gas producers support these statistics showing that current prices are too low to incentivize supply growth. Gordon Huddleston, President of Aethon Energy, stated that Henry Hub prices need to exceed $5 to drive significant development, while Nick Dell’Osso, CEO of Expand Energy (formerly Chesapeake Energy), emphasized the need for prices to be 'materially higher’. These comments underscore a critical reality for the natural gas market, in that higher prices will be necessary to incentivize the production needed to meet surging demand, which benefits natural gas producers.

To capitalize on this higher price dynamic, we’ve focused on identifying the most undervalued natural gas weighted producers, who in a rising commodity price environment, benefit from a dual effect: higher intrinsic values and multiple expansion as their valuations revert to industry standard levels.

Disclaimer

The note does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities. Any such offer or solicitation will be made in accordance with applicable securities laws.

The note is being provided on a confidential basis solely to those persons to whom this monthly note may be lawfully provided. It is not to be reproduced or distributed to any other persons (other than professional advisors of the persons receiving these materials). It is intended solely for the use of the persons to whom it has been delivered and may not be used for any other purpose. Any reproduction of the quarterly note in whole or in part, or the disclosure of its contents, without the express prior consent of Bison Interests, LLC (the “Company”) is prohibited.

No representation or warranty (express or implied) is made or can be given with respect to the accuracy or completeness of the information in the quarterly note. Certain information in the monthly note constitutes “forward-looking statements” about potential future results. Those results may not be achieved, due to implementation lag, other timing factors, portfolio management decision-making, economic or market conditions or other unanticipated factors. Nothing contained herein shall be relied upon as a promise or representation whether as to past or future performance or otherwise.

The views, opinions, and assumptions expressed in this note as of December 2024 are subject to change without notice, may not come to pass and do not represent a recommendation or offer of any particular security, strategy or investment.

The note does not purport to contain all of the information that may be required to evaluate the matters discussed therein. It is not intended to be a risk disclosure document. Further, the note is not intended to provide recommendations, and should not be relied upon for tax, accounting, legal or business advice. The persons to whom this document has been delivered are encouraged to ask questions of and receive answers from the general partner of the Company and to obtain any additional information they deem necessary concerning the matters described herein.

None of the information contained herein has been filed or will be filed with the Securities and Exchange Commission, any regulator under any state securities laws or any other governmental or self-regulatory authority. No governmental authority has passed or will pass on the merits of this offering or the adequacy of this document. Any representation to the contrary is unlawful.

I've been wondering how this will affect these data centers in the future. It could be challenging.

Electricity is a never ending need on planet Earth.