In cyclical industries like oil and gas, the best investment opportunities often emerge during downturns — when sentiment is weak, but long-term fundamentals remain strong. We believe that now is one of those moments.

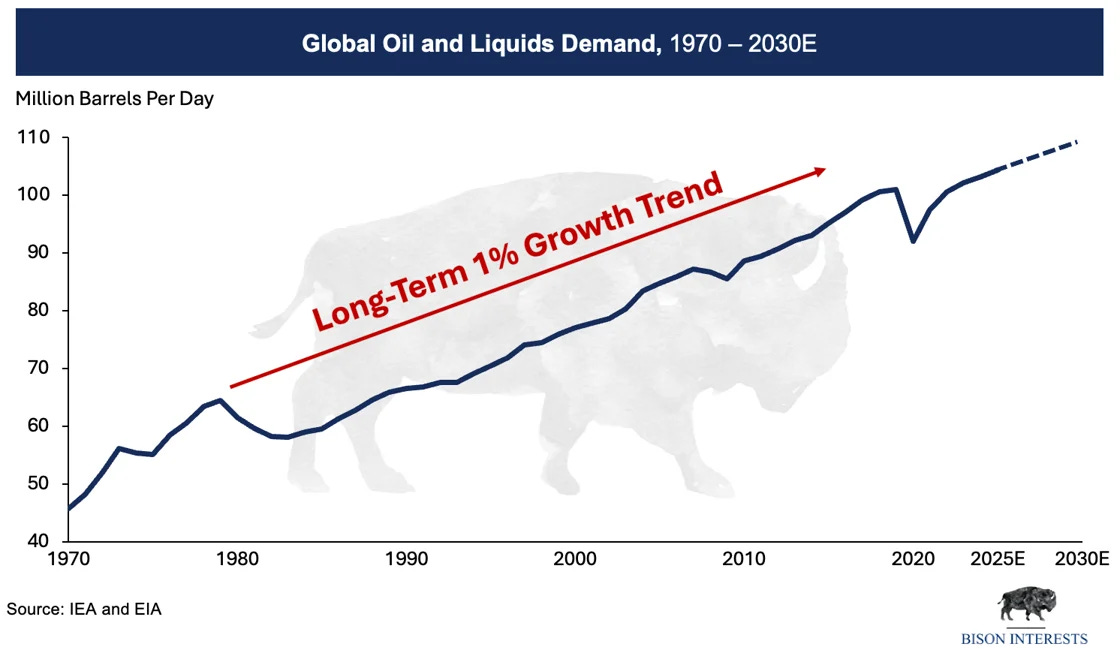

Historically, global oil demand has followed a steady upward trajectory, driven by population growth, industrialization, and rising energy needs across developing economies. The chart below illustrates this long-term demand trend — one that has proven resilient through financial crises, pandemics, and geopolitical shocks.

The recent sell-off in oil and gas equities reminds us of prior periods of fear — most notably during the 2008 financial crisis and the 2020 COVID crash. In both instances, investors who bought during the downturn were rewarded with strong multi-year outperformance as the market recovered and energy demand rebounded.

This time appears no different. As the old saying goes, the time to buy is when there's blood in the streets — or as we prefer to put it, when the market is pricing fear, not fundamentals.

Timing the bottom is nearly impossible and isn’t necessary. In 2020, oil stocks fell sharply throughout the first quarter, ultimately crashing when oil prices briefly turned negative in March. Yet investors who put money to work at any point that year — before, during, or after the crash — still went on to earn multiples on their initial investment in the years that followed.

While the trigger for this market downturn—tariffs—is different from past sell-offs, the likely outcome for oil stocks remains the same. Prices have fallen considerably, but sub-$60 WTI is unsustainable for new drilling, which will slow production just as the global economy continues to demand more oil and related products.

To highlight our conviction in this opportunity, our CIO, Josh Young — who already has the majority of his net worth invested in the fund — recently added substantial funds to his investment. While we can’t predict the exact bottom, we believe the current environment presents significant upside potential and a compelling asymmetric opportunity.

Media Update

In March, Josh was the featured guest for energy law firm Oliva Gibbs’s 2025 Oil & Gas Market Outlook, where he discussed the current state of the oil and gas markets and his outlook for 2025. Later in the month, he appeared on the CEO and Market Experts channel to break down the key drivers behind recent oil price weakness and to share his forecasts for the coming years. Josh’s insights were also featured multiple times in Reuters — first on the progress of Trump’s “Drill-Baby-Drill” agenda, then on a bullish EIA monthly report for oil and petroleum products, and most recently on the uptick in refinery utilization.

Disclaimer

The note does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities. Any such offer or solicitation will be made in accordance with applicable securities laws.

No representation or warranty (express or implied) is made or can be given with respect to the accuracy or completeness of the information in the monthly note. Certain information in the monthly note constitutes “forward-looking statements” about potential future results. Those results may not be achieved, due to implementation lag, other timing factors, portfolio management decision-making, economic or market conditions or other unanticipated factors. Nothing contained herein shall be relied upon as a promise or representation whether as to past or future performance or otherwise.

The views, opinions, and assumptions expressed in this note as of April 2025 are subject to change without notice, may not come to pass and do not represent a recommendation or offer of any particular security, strategy or investment.

The note does not purport to contain all of the information that may be required to evaluate the matters discussed therein. It is not intended to be a risk disclosure document. Further, the note is not intended to provide recommendations, and should not be relied upon for tax, accounting, legal or business advice.

None of the information contained herein has been filed or will be filed with the Securities and Exchange Commission, any regulator under any state securities laws or any other governmental or self-regulatory authority. No governmental authority has passed or will pass on the merits of this offering or the adequacy of this document. Any representation to the contrary is unlawful.

XOP has been a long term hold for me. I'm happy that there is new life emerging in this position. I first heard of Bison Interests from Jason at Wall Street for Mainstreet. There is an underlying positive interest by savvy investors. It's difficult to ignore. Thanks 😊 🫂

Josh How about Critical Material such as Graphene ?

"We make the best Graphene in the World!"

Kjirstin Breure, HydroGraph President and CEO kjirstin.breure@hydrograph.com 408.267.2556

HydroGraph Clean Power "HGRAF" | Statewide Winner | 2024 To The Stars: Kansas Business Awards

Watch

https://www.youtube.com/watch?v=EgmDGN4wmRA

Graphene is the miracle material that is stronger than steel, lighter than paper and the best conductor of electricity on Earth.

Only one small public company produces 99.8 % pure graphene, while most competitors have no more than 50% graphene .

Google this: 99.8% Graphene

Only One Company appears: HydroGraph Clean Power-HG Canadian or HGRAF

"Igniting Material Change"

"We make products lighter, faster and stronger." "We make the best graphene in the world"

Graphene 200 times stronger than steel, harder than diamonds, more conductive than copper, with better electron mobility than silicon

Key Interview HydroGraph (HG) CEO Kjirstin Breure: update on commercialization and graphene development milestones

https://www.youtube.com/watch?v=mngzEQV6m5s

Christopher M. Sorensen Kansas State University Inventor of HydroGraph Graphene Technology

Vice President of R&D

Watch This Video

https://youtu.be/M9k6s-dd7IU

Is Graphene the Next Big Thing? Newsletter writer Jay Taylor

https://taylorjay.substack.com/p/is-graphene-the-next-big-thing

Website www.hydrograph.com

HydroGraph Investor Presentation

https://hydrograph.com/wp-content/uploads/2025/04/HydroGraph-Clean-Power-IR-Deck.pdf

HydroGraph is one of only three globally verified graphene producers, and the only one in the Americas

https://hydrograph.com/investors/investors-overview/

HydroGraph is on verge of commercialization. In "Home Stretch." Over 50 major manufacturers testing the Hydrograph graphene (including the Department of Defense).

Jim Rogers On Real Vision..Graphene - thinks it will be big someday soon.

“In the 12 years we’ve been experimenting with graphene, carbon nanotubes and nano materials in general, we’ve never seen anything like the results we’ve gotten with HydroGraph’s FGA-1 graphene. We’re excited about the potential to marry cost savings with sustainability as we move forward.”

Chris Surbrook, Head of New Business Development Midland Compounding & Consulting

Graphene is:

200 times stronger than steel.

It is extremely flexible as it can bend and stretch to 120% of its original size.

Its thermal conductivity is 10 times that of copper.

It is impermeable so that all elements, even hydrogen, cannot penetrate its structure.

Its electrical conductivity is 1,000 times current capacity of copper.

Its electronic behavior is unique in that electrons can move at near the speed of light through it.

It is highly transparent.

Flame resistant

UV resistant

Extremely thin owing to its single layer atomic structure

Extremely stiff