Oil Market Update

Oil prices and related equities have struggled in the second half of 2024 as sentiment has turned bearish amidst an oversupplied oil market outlook for 2025, a view that was recently highlighted in the EIA’s November 2024 Short-Term Energy Outlook:

“By 2Q25, we expect OPEC+ production increases and supply growth from countries outside of OPEC+ will outweigh global demand growth and cause oil to be put into inventory… We forecast that inventory builds will put downward pressure on crude oil prices…”

This narrative, combined with ongoing ESG concerns, is likely driving the continued billions of dollars in outflows from the oil and gas sector.

It has also driven net crude oil positioning—the total positions held in crude oil futures and contracts—to its lowest level in over a decade, reflecting bearish sentiment and expectations of continued market oversupply.

Reality: Oil Demand Outpacing Supply in 2024, Driving Unexpected Global Inventory Draws and Leaving U.S. Oil Stocks at 20-Year Lows

If the EIA's 2025 projections will prove accurate, current trends must reverse. In 2024 to date, global petroleum and other liquids demand has outpaced production by an average of 0.58 mbd, with the deficit growing throughout the year.

This has proven the EIA's forecast from this time last year wrong, as EIA had then projected production exceeding demand in 2024 and a global inventory build of 45 million barrels. Instead, stronger-than-expected demand growth, particularly from India and other non-OECD developing economies, has shifted the outlook. Global inventories are now projected to experience a full-year withdrawal of 186 million barrels.

In our view, it is likely the EIA is still underestimating the full-year withdrawal, as early data from Kpler on Chinese oil imports through November indicates the country is on pace for a record-breaking month. Imports are approximately 1.8 million barrels per day higher than November 2023, aligning with China's significant stimulus program and signaling growing economic activity and rising oil demand.

Tightening market conditions are most evident in the United States, which for the past several years has held its lowest oil inventories in the last two decades. Inventory levels were further strained by the Biden administration's release of nearly 300 million barrels from the Strategic Petroleum Reserve in 2022, a measure taken to combat high energy prices at the time.

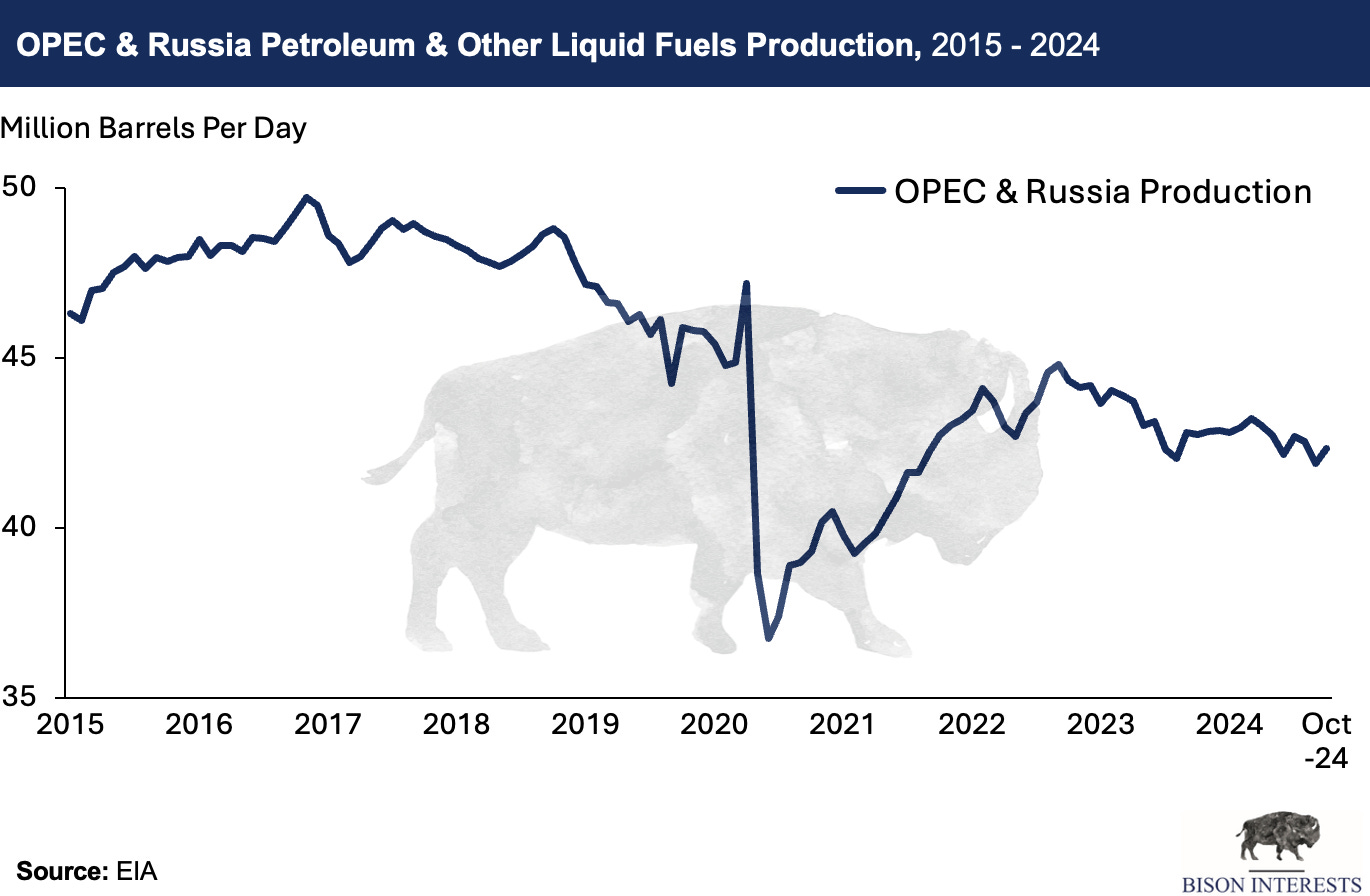

With demand continuing to grow, production must rise to balance the market. The EIA projects 2025 demand to increase to 104.3 mbd, while current 2024 supply is estimated at 102.6 mbd. While OPEC is expected to mostly close this gap by unwinding 2.2 mbd of production cuts over 2025—an unwinding that has already been delayed by six months—we are skeptical regarding the true production capacity of OPEC's two largest producers, Saudi Arabia and Russia, and their ability to meet future demand increases. This skepticism is supported by them having never actually produced at their stated capacity levels for an extended period, declining production over the past decade, and a notable lack of significant production increases during periods of $100+ WTI in 2022 relative to pre-COVID trends.

If OPEC does not balance the market, the burden of meeting global oil demand will fall to non-OPEC nations. Growth from these nations is slowing – the Permian Basin region and Guyana oil fields, two key drivers of non-OPEC production growth, are expected to contribute 0.3 mbd and 0.25 mbd of additional production, respectively, in 2025 (compared to 0.4 mbd and 0.3 mbd in 2024). Combined with other non-OPEC sources, total 2025 production growth from non-OPEC nations is projected at 1.5 mbd (compared to an average of 1.85 mbd for the previous two years), leaving a shortfall of 0.2 mbd considering the 1.7 mbd required to balance the market.

Beyond 2025, oil demand is projected to keep rising, and with declining OPEC production and slowing non-OPEC production growth, the supply shortfalls seen in 2024 may persist. Given the inelastic nature of oil demand, such conditions would trigger significant price volatility. For example, from December 2020 to May 2022, an average global inventory draw in petroleum and other liquids products of 1.34 mbd drove WTI prices from $41 to $110. During this period, Bison delivered a 900% return net of fees, earning recognition as likely the world’s top-performing equity fund in 2021. With the latest global inventory withdrawals averaging 0.91 mbd in Q3 2024 and WTI trading at $68 as of the week ending November 15, we see market fundamentals aligning for a potential similar bull run in 2025 and beyond.

Media Update

In October, our CIO Josh Young's commentary was featured on CNBC, where he discussed the possibility of an Israeli strike on Iranian oil supplies and the effect this would have on oil prices. Later in the month, Josh served as a panelist at the Minerals and NonOp Assembly in Houston, covering topics such as the perplexing phenomenon of inverse demand for public equities, the benefits of returning capital to shareholders versus growth reinvestment, and a comparison of recent public and private deals in the oil and gas space. Josh was also quoted in Reuters, commenting on the recent decline in oil and oil products in inventories in the US.

Bison News & Admin

We are pleased to welcome junior analyst Brendan Cumming to the team. Brendan holds an Economics degree from Princeton University and a Master’s in Energy Economics from Rice University. In his role at Bison, Brendan is assisting with company and market analyses and facilitating back-office functions.

Important Disclaimer: The note does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities. Any such offer or solicitation will be made in accordance with applicable securities laws. No representation or warranty (express or implied) is made or can be given with respect to the accuracy or completeness of the information in the monthly note. Certain information in the monthly note constitutes “forward-looking statements” about potential future results. Those results may not be achieved, due to implementation lag, other timing factors, portfolio management decision-making, economic or market conditions or other unanticipated factors. Nothing contained herein shall be relied upon as a promise or representation whether as to past or future performance or otherwise. The views, opinions, and assumptions expressed in this note as of November 2024 are subject to change without notice, may not come to pass and do not represent a recommendation or offer of any particular security, strategy or investment. The note does not purport to contain all of the information that may be required to evaluate the matters discussed therein. It is not intended to be a risk disclosure document. Further, the note is not intended to provide recommendations, and should not be relied upon for tax, accounting, legal or business advice. The persons to whom this document has been delivered are encouraged to ask questions of and receive answers from the general partner of the Company and to obtain any additional information they deem necessary concerning the matters described herein. None of the information contained herein has been filed or will be filed with the Securities and Exchange Commission, any regulator under any state securities laws or any other governmental or self-regulatory authority. No governmental authority has passed or will pass on the merits of this offering or the adequacy of this document. Any representation to the contrary is unlawful.

How do you see Journey nowadays?