Bison is Opposed to The Proposed Take-Under of Pipestone by Strathcona

(Important Disclaimer at the Bottom)

Bison owns shares of Pipestone Energy (TSX: PIPE), and we intend to vote against Pipestone’s proposed reverse merger with Strathcona. We believe this proposed deal substantially undervalues Pipestone, and that another offer may emerge at a premium to it. Pipestone shares will likely recover in price if the deal is rejected by shareholders.

Our analysis indicates Pipestone’s intrinsic value is ~86% higher than the allocated $2.72/share in the Strathcona deal, per recent transaction values in the Montney, Pipestone’s NAV/share implied by recent crown land transactions, and comparable valuations of publicly traded Montney focused peers:

Bison Background

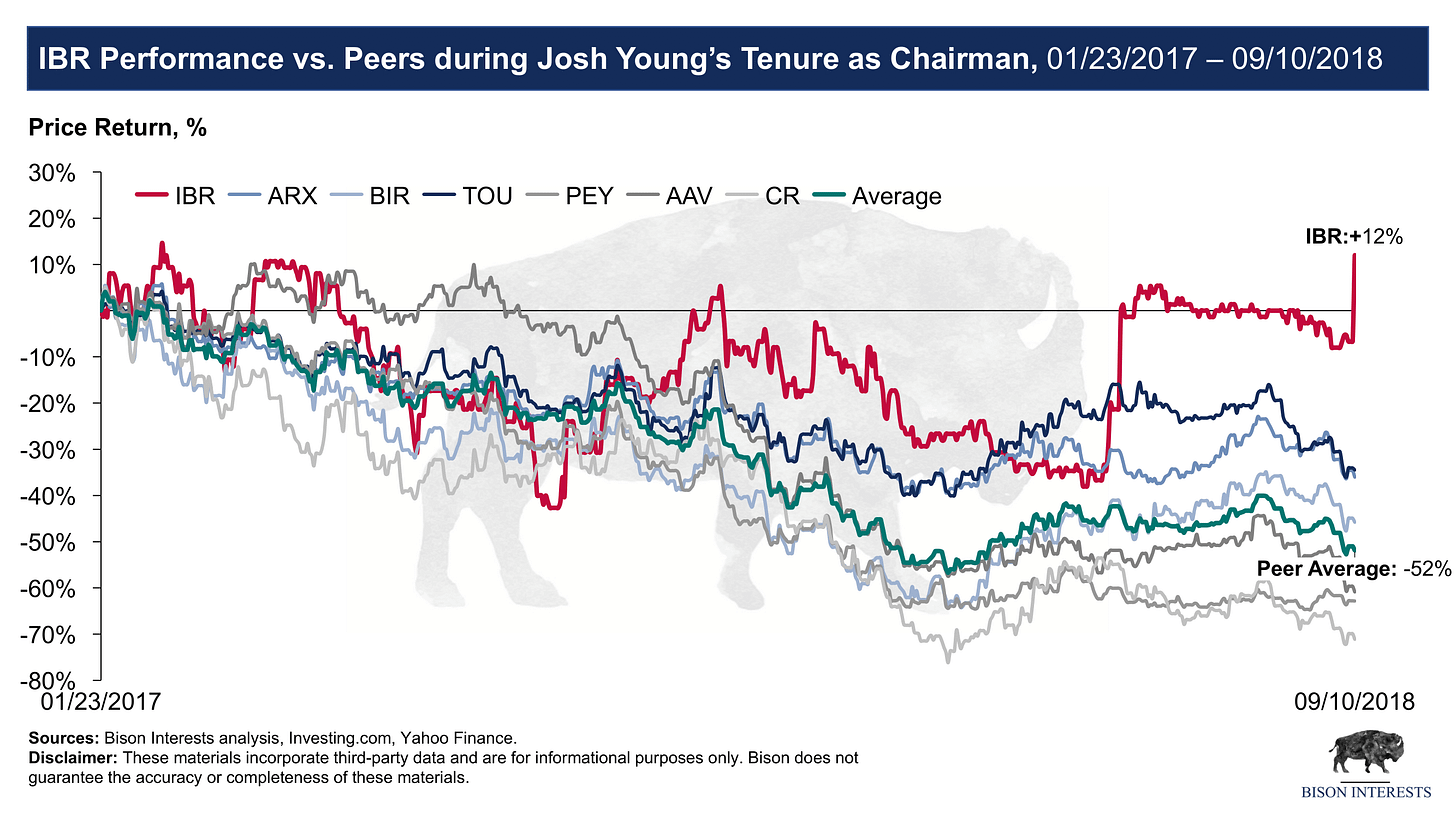

We have relevant experience to assess Pipestone’s situation. Our firm Bison Interests advises an investment strategy focused on publicly traded oil and gas equities, which holds shares of Pipestone. Bison’s CIO, Josh Young, was the Chairman of Iron Bridge Resources, a Montney-focused oil & gas company with assets in close proximity to Pipestone’s. While Josh was Chairman of Iron Bridge, the company materially outperformed its peers. Josh led the company through the divestment of non-core assets, delineation of the core asset, and the sale of Iron Bridge at a 78% premium - including a stepped-up offer from the private equity-backed buyer:

Beyond his specific-area transaction, governance, and management experience, Josh has proven his expertise in oil and gas securities analysis through a market-beating track record as the sole portfolio manager for Bison since its inception.

Since May 2015, Bison has significantly outperformed the small-cap publicly traded energy stock index as well as Pipestone and its predecessor’s share price performance. We think there is upside for Pipestone shares from here in lieu of the proposed Strathcona take-under.

Proposed Pipestone / StrathCona Transaction Overview

The proposed transaction, which Bison intends to vote against, would involve Strathcona Resources acquiring 100% of Pipestone’s outstanding shares via a reverse merger. If the transaction were to close, Strathcona would be listed as a publicly traded company, and Pipestone shareholders would receive 8.87% of the basic outstanding shares of the newly listed combined entity (AmalCo) upon closing.

Per the announcement of the proposed deal, the pro forma entity would be estimated to have an initial market capitalization of ~$8.6B, and with a combined ~$2.9B in net debt, an initial enterprise value of ~$11.5B. This implies a value of ~$1B for Pipestone and ~$10.5B for Strathcona:

Using Pipestone’s Q2 exit production rate of ~37,000 Boe/d, this proposed transaction implies a deal value of $27,596/Boe/d for Pipestone:

By means of comparison, this deal implies an EV/Boe/d of $70,900 for StrathCona, nearly 3 times higher than that of Pipestone:

While Strathcona has more production with a higher liquids percentage, Pipestone’s assets are in the premium liquids-rich Montney shale, with a large inventory of high-return capital deployment opportunities. With Canadian M&A activity ramping up and many potential buyers for Pipestone’s assets a higher bidder may emerge for Pipestone, and its shares may trade higher on their own if the proposed Strathcona deal is rejected outright.

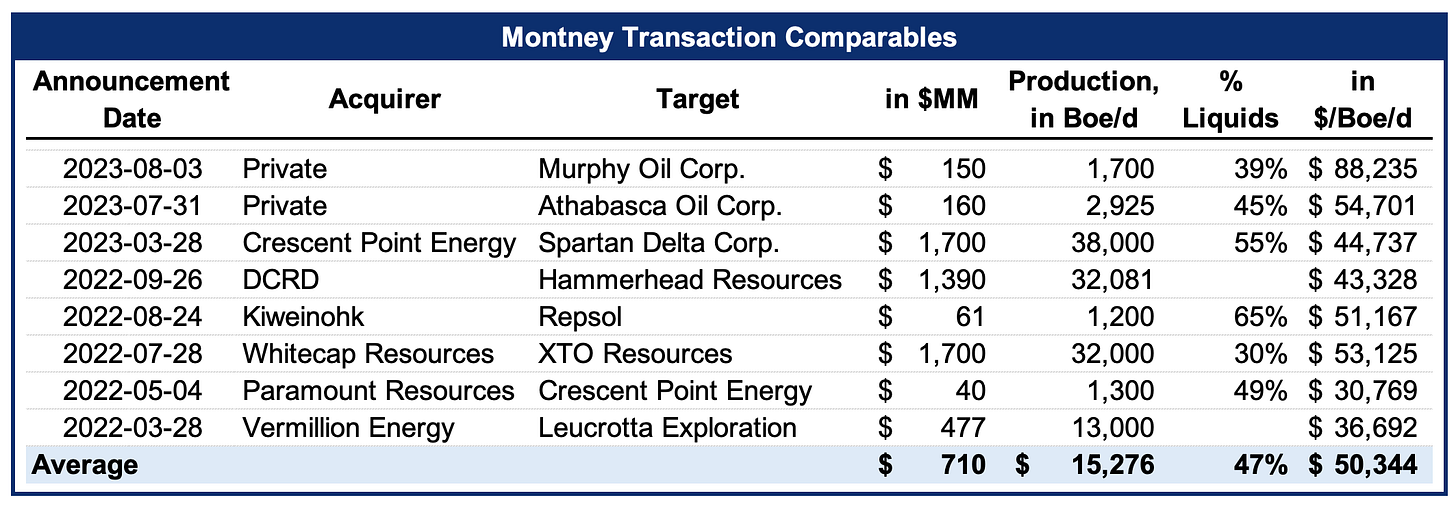

Recent Comparable Transactions in the Montney

With M&A activity ramping up in the Montney, transaction multiples have been rising. Pipestone shareholders may be able to obtain a better price from bidders with nearby assets, or those looking to enter the area to obtain high-return drilling inventory:

In the past month, a private equity-backed company acquired Montney and Duvernay assets from Athabasca at $54,701/Boe/d, and a private company (possibly the same buyer) bought overlapping assets from Murphy Oil for $88,235/Boe/d.

If Pipestone were to only transact at the average price in similar Montney transactions over the last 18 months, this would imply more than 115% upside from the deal announcement date:

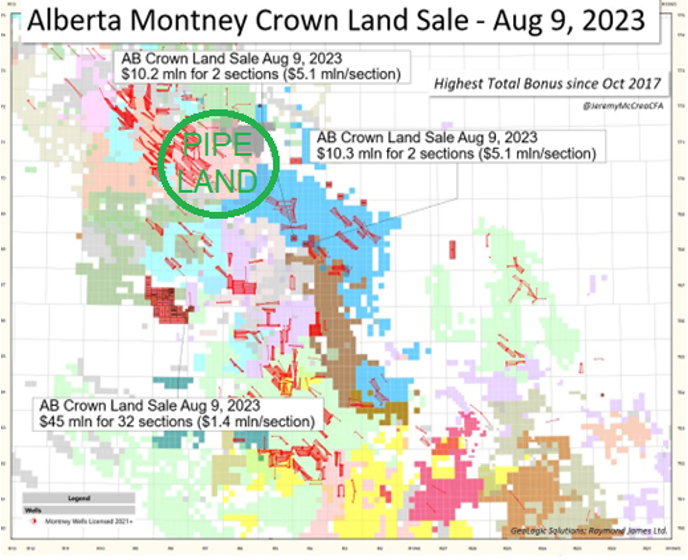

Recent Land Sales

In support of Montney M&A trends, values in Crown land sales in the Alberta Montney have also been rising. On August 9th, Montney Crown near Pipestone’s assets leased for $5.1MM per undeveloped section:

Sources: GeoLogic Solutions, Raymond James, Jeremy McCrea

As can be seen above, recent Crown land leases at higher prices near Pipestone may imply a substantial value for Pipestone’s underdeveloped acreage. Specifically, the eastern portion of Pipestone’s land is currently being delineated and may deliver some of the highest-performing wells in the Montney, but is currently not being ascribed value by the market and nor is it reflected in Pipestone’s latest reserve report.

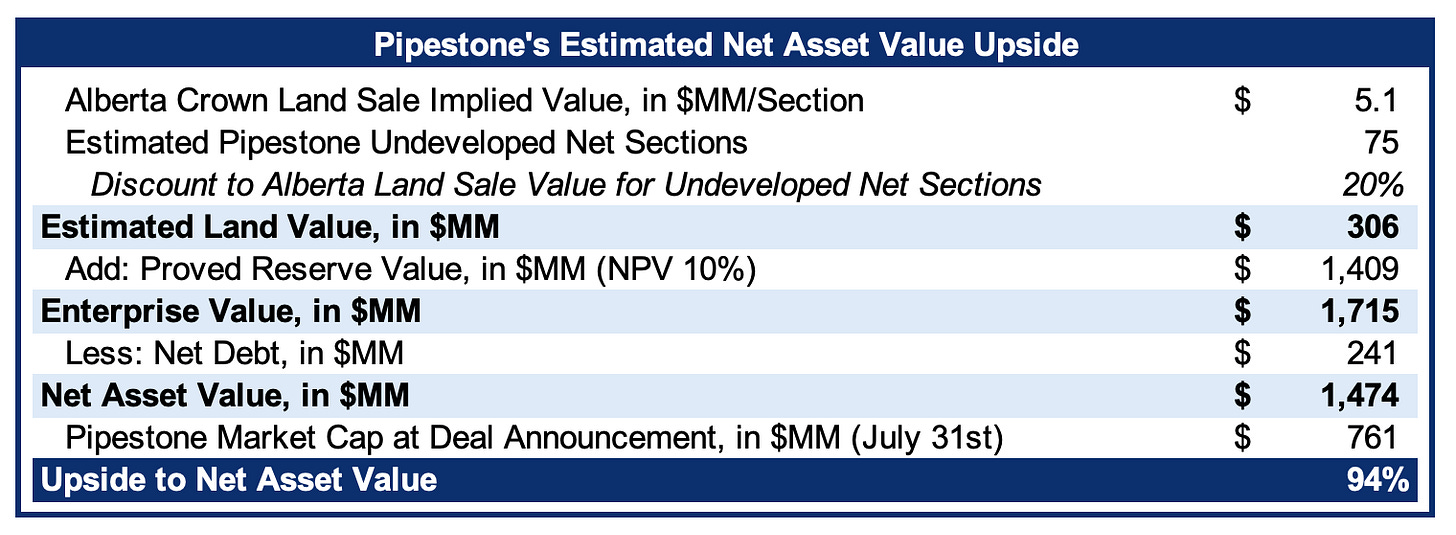

We used the recent Crown land sales as an indicator of the potential sale value of a portion of Pipestone’s undeveloped land and discounted that value to be conservative. To estimate Pipestone’s NAV, we added the proved reserve value from the latest reserve report, and subtracted their net debt:

As can be seen above, we estimate there is ~100% upside to Pipestone’s shares if a portion of its undeveloped land were to trade in line with comparable land transactions, even after applying a meaningful discount. The proposed Strathcona transaction appears not to ascribe it any value, and there is further potential upside from Pipestone’s ongoing delineation activities, which we discuss below.

Delineation Efforts May Drive Further Upside

Pipestone’s production was negatively affected by Canadian wildfires in Q2. Despite these complications, Pipestone still managed to exit the quarter with production above its guidance range and average production of 33,143 Boe/d.

This production figure also excludes recent delineation wells on promising southeastern lands, which will likely contribute meaningful production in the future when they are connected to pipelines for sales. With the wildfires in the rearview, Pipestone’s production may “surprise” to the upside in subsequent quarters.

Pipestone estimates it will spend $45MM on delineation wells in 2023. The market has been awaiting the results of Pipestone’s 03-30 exploratory well, which spud from its 11-09 well pad in March:

Source: Raymond James

Analysts had been expecting results from this well in Pipestone’s Q2 announcement; however, the program fell behind schedule and remains inconclusive. The 03-30 well results may be transformative for Pipestone and it is reasonably likely that Pipestone’s shares would re-rate substantially when announced, if successful. StrathCona may be opportunistically trying to acquire Pipestone at a lower valuation ahead of this announcement.

While Strathcona was likely provided the well test results as a part of their due diligence, Pipestone’s shareholders are being asked to vote in favor of the sale of the company to Strathcona without them – this implies good results and further potential standalone value for Pipestone.

Despite suffering issues at the completion stage, the 02-20 well, which was completed on the same pad in 2017, still delivered an impressive IP7 test rate of 710 bbl/d of oil and 3.4MMcf/d or 1,277 Boe/d. By comparison, the 03-30 exploratory well was completed with a much better design has a longer lateral length, more tonnage, higher frac intervals, and a much higher pump rate. For this reason, along with its proximity to a previously high-performing well on the same pad, this well may outperform the prior one with the potential to have one of the highest IP rates in the Montney.

The 03-30 well may also help prove up a meaningful part of Pipestone’s undrilled acreage to the Southeast, while most of Pipestone’s development focus has traditionally been to the west. This could help provide an uplift to Pipestone’s undrilled acreage while increasing proved reserves, resulting in a higher net asset value than we were previously estimating.

Comparable Public Companies

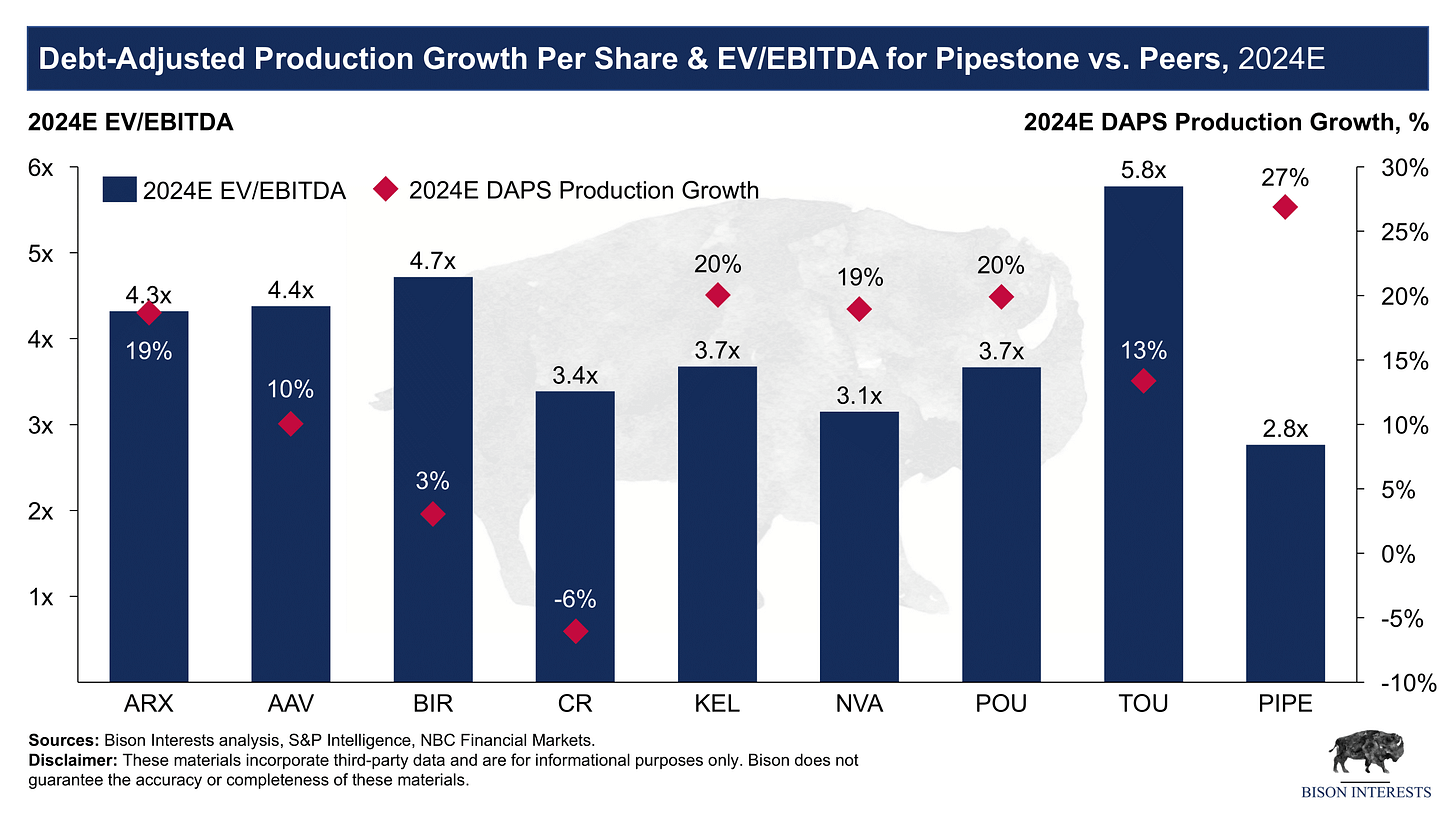

Pipestone’s market valuation is materially lower than other publicly traded Montney operators:

As can be seen above, Pipestone trades at a steep discount to Montney peers on various relevant valuation metrics. For this reason, we believe the Strathcona proposed deal is opportunistic and takes advantage of Pipestone’s large valuation discount.

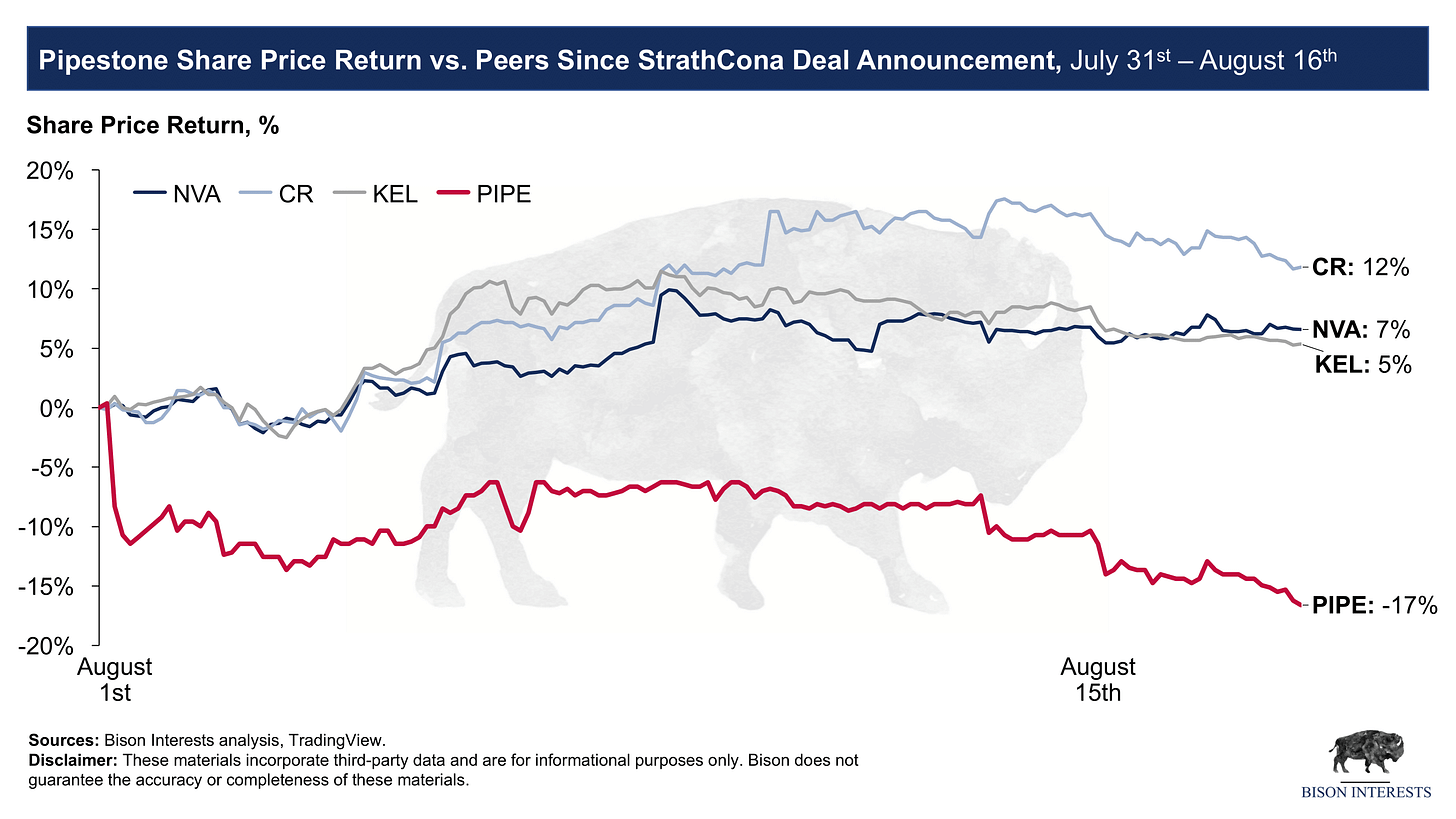

Multiple compression is also reflected in Pipestone’s share price underperformance versus peers over the last year, which has worsened since the deal announcement:

Despite Pipestone’s low valuation, consensus estimates (from shortly before the Strathcona deal announcement) show Pipestone with the highest production growth per share on a debt-adjusted basis of its comps, despite a significantly lower valuation:

Conclusion/Takeaways

If the Strathcona deal is voted down, Pipestone should trade up to its fair value in public markets over time. Healthy production growth and promising exploration results with a dividend and likely free cash flow generation offer a compelling value proposition to us, particularly after the sell-off in the stock after the deal announcement.

There is also the possibility of a premium offer, either before the vote on the Strathcona proposed deal or after the rejection of the deal. In such a scenario, or if it becomes clear that enough shareholders will oppose the deal such that it will not be approved, Strathcona may offer a more reasonable transaction that more fairly allocates value to Pipestone shareholders:

In our view, Pipestone’s board is selling its shareholders short by recommending this transaction. While we understand and appreciate that Pipestone ultimately may not sell for our assessment of its intrinsic value, if Pipestone were to be bought, we’d like to see it transact for a price closer to its intrinsic value. We will be voting our shares against the too-low Strathcona offer.

Important Disclaimer: Opinions expressed herein by the author are not an investment or vote recommendation and are not meant to be relied upon in investment or voting decisions. The author is not acting in an investment adviser capacity. This is not an investment research report. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC or CSA filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable but have not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice. Funds the author advises owns shares in Pipestone Energy (TSX: PIPE) and may buy or sell shares without any further notice. This is not a solicitation or recommendation to vote for or against the transaction discussed.

The note does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities. Any such offer or solicitation will be made in accordance with applicable securities laws.

The note is being provided on a confidential basis solely to those persons to whom this quarterly note may be lawfully provided. It is not to be reproduced or distributed to any other persons (other than professional advisors of the persons receiving these materials). It is intended solely for the use of the persons to whom it has been delivered and may not be used for any other purpose. Any reproduction of the quarterly note in whole or in part, or the disclosure of its contents, without the express prior consent of Bison Interests, LLC (the “Company”) is prohibited.

No representation or warranty (express or implied) is made or can be given with respect to the accuracy or completeness of the information in the quarterly note. Certain information in the monthly note constitutes “forward-looking statements” about potential future results. Those results may not be achieved, due to implementation lag, other timing factors, portfolio management decision-making, economic or market conditions or other unanticipated factors. Nothing contained herein shall be relied upon as a promise or representation whether as to past or future performance or otherwise.

The views, opinions, and assumptions expressed in this note as of August 2023 are subject to change without notice, may not come to pass and do not represent a recommendation or offer of any particular security, strategy or investment.

The note does not purport to contain all of the information that may be required to evaluate the matters discussed therein. It is not intended to be a risk disclosure document. Further, the note is not intended to provide recommendations, and should not be relied upon for tax, accounting, legal or business advice. The persons to whom this document has been delivered are encouraged to ask questions of and receive answers from the general partner of the Company and to obtain any additional information they deem necessary concerning the matters described herein.

None of the information contained herein has been filed or will be filed with the Securities and Exchange Commission, any regulator under any state securities laws or any other governmental or self-regulatory authority. No governmental authority has passed or will pass on the merits of this offering or the adequacy of this document. Any representation to the contrary is unlawful.

Good work!

Agreed, it's probably not the best deal for Pipestone but a really good deal for Strathcona. Pipestone would get shares in Strathcona for approx ~ $70K/ per BOE/ day. Granted, it's for a heavier oil company. But that's at the higher end of heavy oil/ thermal sands deals. That seems like a high price for and a lot of faith in a relatively unknown company.

Not involved and not investment advice.

Interesting note. Is it fair to say that if the deal goes ahead someone buying today at ~2.38 would net about a 13% return with the deal value of $2.72 per share? I would think some risk there to the value