Capitalizing on The Natural Gas Boom – LNG Exports, AI Data Centers, and Undervalued Natural Gas Producers

Natural gas is booming in the US. Prices are up substantially. There is a surge in the construction of LNG export facilities, petrochemical plants, and AI oriented data centers. But the rig count is down, development inventory is depleted, and supply is disappointing. In the midst of this boom, we have identified compelling opportunities, including producers trading at enormous free cash flow and dividend yields.

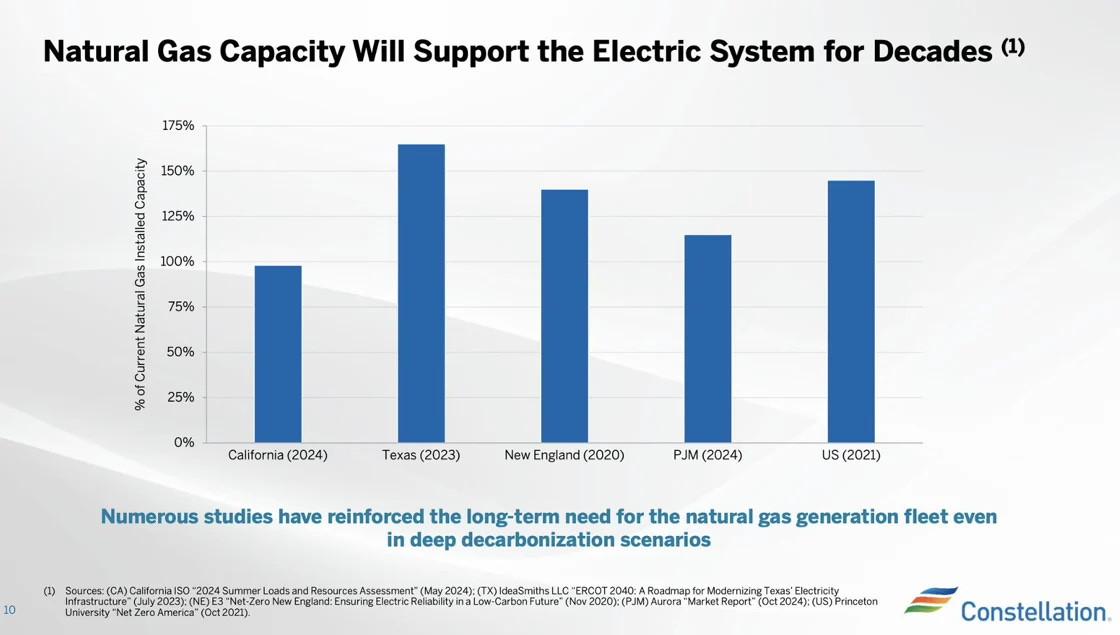

In our recent white paper, we outlined why we think natural gas prices will increase through the end of the decade. LNG export facility expansions are projected to boost gas demand by 12 Bcf/d by 2028, while increased power consumption from AI data centers, grid electrification, and coal displacement are expected to further drive natural gas demand, a view that is supported by studies from grid operators nationwide.

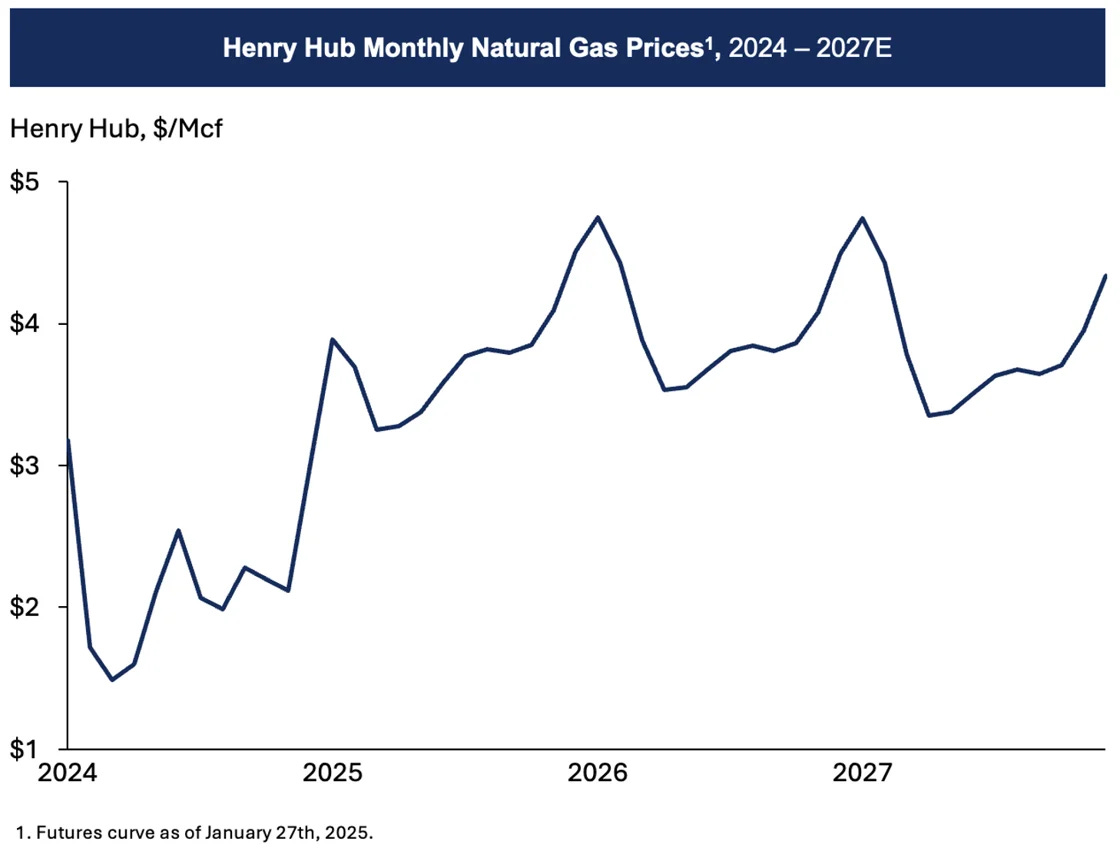

On the supply side, a year-over-year decline in gas rigs and recent statements from natural gas company executives point to the need for significantly higher natural gas prices to incentivize future supply development. These demand and supply factors are driving higher gas prices on the futures curve relative to 2024 levels.

Cashing In On The Natural Gas Boom

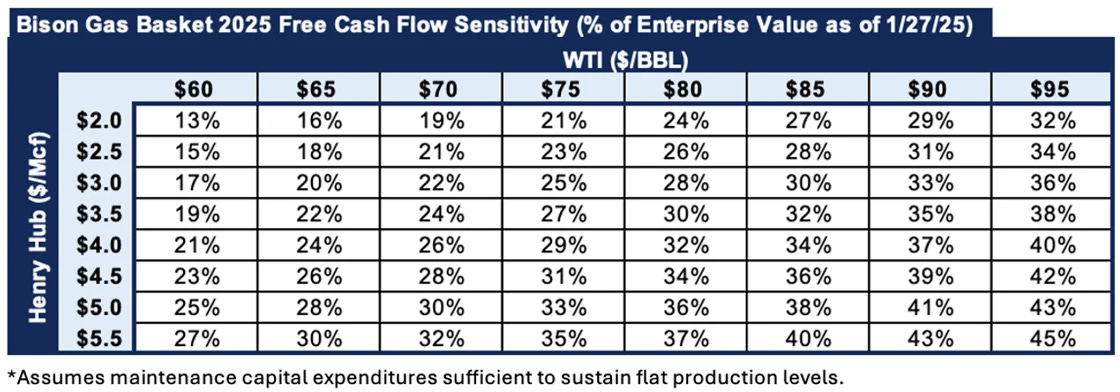

The market expects gas prices to average ~70% higher over the next several years, as can be seen above. This move would result in substantially higher cash flow for select publicly traded natural gas producers, which are already trading at a steep discount to peers – and that have reflected their large free cash flow generation via high dividend payouts over the past year.

Even if the forward curve for natural gas prices proved to be wrong and prices were to fall instead of rise, our gas basket yields would likely be sustainable and could even potentially increase for two reasons:

1) Bison gas basket companies have strong balance sheets which can be used for accretive acquisitions, to generate interest income, and to support years of distributions despite a low-price environment, as was seen in the low natural gas price environment of 2024.

2) Their high return inventory, large land positions, and low to moderate production decline rates enable low maintenance capital expenditures to sustain flat production for years.

These two factors result in substantial free cash flows, with any increase in gas prices directly translating into additional excess cash flow that can be returned to shareholders through higher dividends and share buybacks.

Why is the market offering such a bargain?

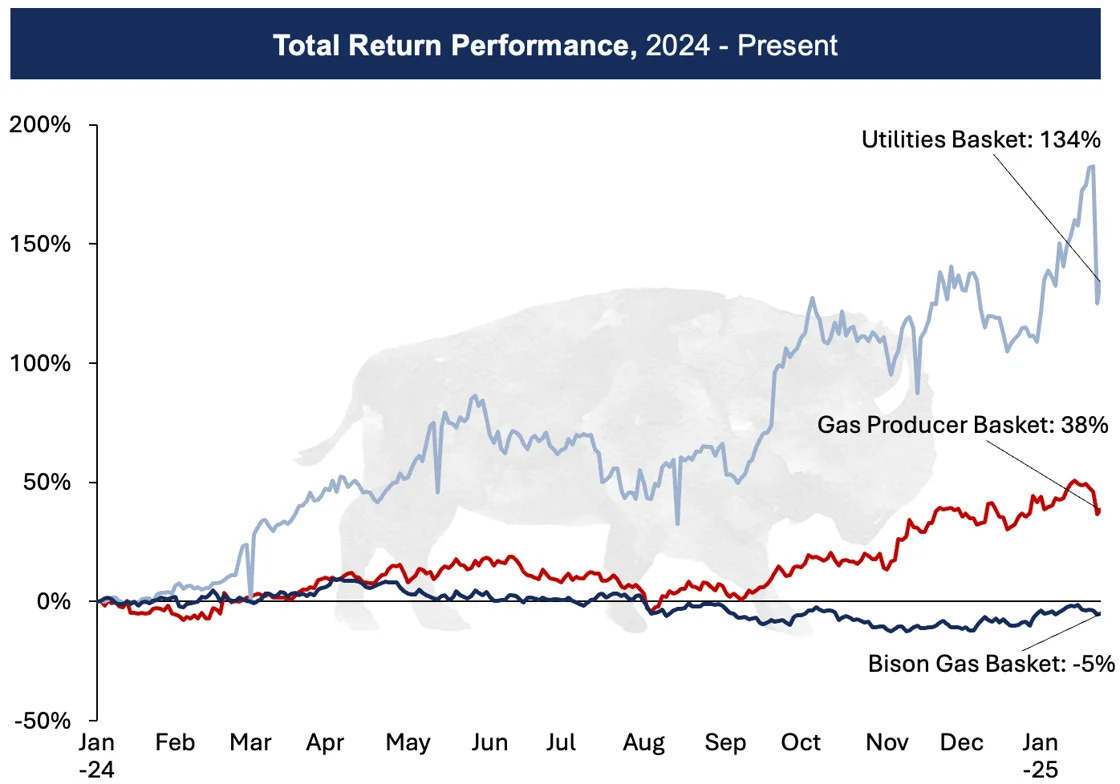

Two of the companies in our gas basket emerged from bankruptcy within the last decade, a factor that often deters investors and contributes to undervaluation. We do not view this as a risk or obstacle going forward: both companies underwent a complete transformation of executive and board leadership and have adopted a fundamentally different approach to operations and financial management. Today, neither company carries substantial debt on their balance sheet. Instead of paying interest, at least one of them earns interest income on their substantial cash reserves. Despite these improvements, and despite recent highly economic wells in their core areas, both have underperformed the broader gas and utilities market in the past year, weighing down the basket and providing ample room for future outperformance as these companies catch up to peers.

Also, ESG investing trends, decreasing commodity prices, and the attractiveness of other investments like tech and AI have led to massive capital outflows from the energy sector and have left many energy equities, especially small caps, deeply undervalued.

Lastly, the small size of the companies we’re invested in, coupled with historical bankruptcy in an already out-of-favor sector, has created a triple disadvantage, leaving some of these positions particularly undervalued.

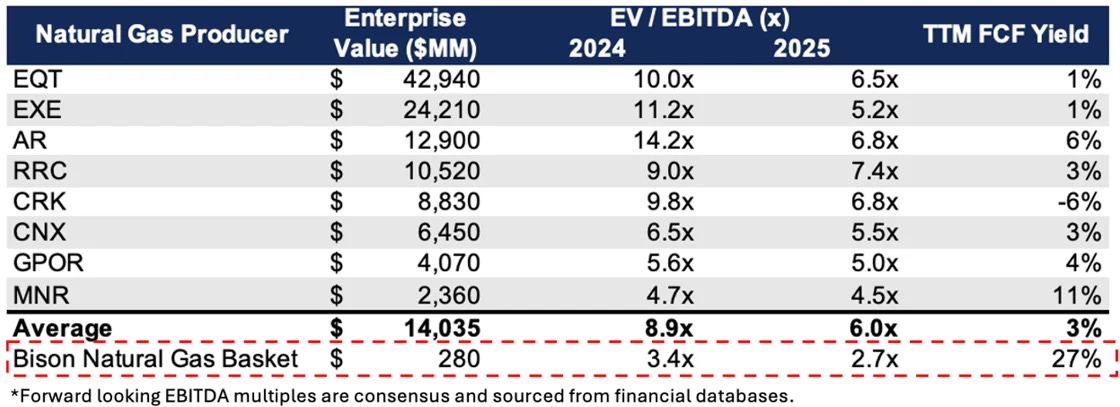

Fortunately, cash is cash. While no one can repeatedly successfully predict short-term market movements or sector fund flows, capital will likely gravitate over time to opportunities offering the greatest returns. Funds flows returning to the energy sector and to the Bison gas basket offers the potential for significant share price appreciation. But in the meantime, many of these companies are paying high dividends and share buybacks. As shown in the table above, these investments are trading at less than 50% of the average EBITDA multiples of larger public natural gas companies (EBITDA serves as a proxy for cash generated from operations, a commonly used valuation metric in oil & gas). If the Bison gas basket were only to trade in line with these peers, or even slightly below them on a multiple basis, their share prices could more than double. And they are paying us handsomely to wait.

We Are Being Paid To Wait

We find the Bison gas basket to be compelling. High free cash flow yields should provide a margin of safety against short-term stock price fluctuations, albeit with continued risk of mark-to-market volatility. Over the longer term, LNG facility expansions and the power needs of AI data centers will likely substantially increase demand for natural gas. This demand growth and the concurrent undersupply disproportionately benefit Bison’s natural gas basket, providing the potential for significant underlying share price appreciation while supporting the continuation of large capital returns to shareholders.

Media Update

In December, our CIO, Josh Young, began the month with a debate against analyst Paul Sankey on the outlook for oil. Subsequently, Mr. Sankey has adopted a bullish stance on oil. Later, Josh appeared on the Minerals & Royalties Podcast, sharing insights on the activity of minerals and non-op public equities. He also joined Bloor Street Capital, where he discussed his oil market outlook for 2025.

Disclaimer

The note does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities. Any such offer or solicitation will be made in accordance with applicable securities laws.

The note is being provided on a confidential basis solely to those persons to whom this monthly note may be lawfully provided. It is not to be reproduced or distributed to any other persons (other than professional advisors of the persons receiving these materials). It is intended solely for the use of the persons to whom it has been delivered and may not be used for any other purpose. Any reproduction of the quarterly note in whole or in part, or the disclosure of its contents, without the express prior consent of Bison Interests, LLC (the “Company”) is prohibited.

No representation or warranty (express or implied) is made or can be given with respect to the accuracy or completeness of the information in the quarterly note. Certain information in the monthly note constitutes “forward-looking statements” about potential future results. Those results may not be achieved, due to implementation lag, other timing factors, portfolio management decision-making, economic or market conditions or other unanticipated factors. Nothing contained herein shall be relied upon as a promise or representation whether as to past or future performance or otherwise.

The views, opinions, and assumptions expressed in this note as of January 2025 are subject to change without notice, may not come to pass and do not represent a recommendation or offer of any particular security, strategy or investment.

The note does not purport to contain all of the information that may be required to evaluate the matters discussed therein. It is not intended to be a risk disclosure document. Further, the note is not intended to provide recommendations, and should not be relied upon for tax, accounting, legal or business advice. The persons to whom this document has been delivered are encouraged to ask questions of and receive answers from the general partner of the Company and to obtain any additional information they deem necessary concerning the matters described herein.

None of the information contained herein has been filed or will be filed with the Securities and Exchange Commission, any regulator under any state securities laws or any other governmental or self-regulatory authority. No governmental authority has passed or will pass on the merits of this offering or the adequacy of this document. Any representation to the contrary is unlawful.