Diamondback Acquires Endeavor in $26 Billion Permian Oil Deal, With Promising Read-Through for Independent Producers like Vital Energy

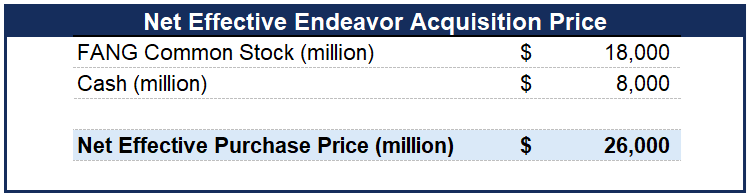

On Monday February 12th, Diamondback Energy ($FANG, NYSE) announced its acquisition of Endeavor Energy to add to its Permian basin assets. This transaction adds about 357,000 BOEPD and 344,000 net acres to FANG’s asset base. Diamondback is financing this acquisition with $18 Billion in common stock issuance and $8 billion of cash, funded from cash on hand and debt issuance.

Diamondback has disclosed it is buying approximately 357,000 BOE/D of existing production from Endeavor, along with significant inventory from Endeavor’s 344,000 net acreage position. At a $26 billion deal price, this implies deal metrics of $72,829 per BOE/D, $133,333 per BO/D, and $75,581 per acre:

On a $ per BOE/D basis, this deal is the second most expensive Permian acquisition since the start of 2023, only trailing Exxon’s acquisition of Pioneer, which was priced at $89,397 BOE/D in October 2023.

The trend of increasingly highly valued deals in the Permian basin is promising for the few remaining sizeable assets potentially available for purchase from private holders. And it may offer some potential for higher valued equities for sizeable publicly traded companies with similar asset footprints.

Acquisition Implications for VTLE

Diamondback’s acquisition of Endeavor for $26 billion has implications for Vital Energy ($VTLE, NYSE). VTLE has less production and acreage compared to Endeavor, its production is less oily and thus less valuable, and it has less booked inventory than Endeavor. However, looking at the pro-forma acreage maps for Diamondback and Vital, one can see the similarities in the footprints and reasonable attractiveness of Vital’s asset package if it were available in a private market sale:

As can be seen in the above land map, Vital has dramatically repositioned itself over the past few years through numerous acquisitions. In a recent corporate presentation, Vital illustrates its significant improvement in well productivity though this transformation, as well as providing a history and an indication of increased acreage position, drilling inventory, and oil production:

This background is helpful in considering the implications of Diamondback’s acquisition of Endeavor, if any, to Vital Energy’s valuation in a sale transaction. The pure math illustrates enormous upside on production and land values. There is so much upside that, even if Vital were heavily punished for less claimed drilling inventory and lower well productivity, there could still easily be well over 100% upside to the company in a sale. The discount is so extreme that there is a good argument that VTLE shares are materially undervalued even if the company remains public as a going concern.

Again, this does not mean Vital’s shares would necessarily garner this sort of return if it were to immediately put itself up for sale. There are numerous considerations that could affect deal values. As there is no announced sale process, transaction value is only one of a number of considerations for the potential public market value for Vital over time. However, with a strong trend of high valuations on larger Permian transactions, and with Vital continuing to grow its size, scale and well productivity through mostly accretive acquisitions since 2019 and improved operations over the past 18 months, Vital appears compellingly undervalued here at $46 / share. And with FANG shares up nearly 20% since the recently announced acquisition of Endeavor, Permian deal mania may continue, potentially sending deal values higher and catalyzing a re-rate of relevant producers’ share prices.

Important Disclaimer: Opinions expressed herein by the author, Josh Young, are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment adviser capacity. This is not an investment research report. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies SEC filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice. The author and funds the author advises own shares in Vital Energy ($VTLE, NYSE) and may buy or sell shares without any further notice.

It was also encouraging to see that Michael Burry has held onto the shares of Vital Energy he bought a while ago. He might believe that also that it is undervalued in the market. Thanks for the heads-up article!

Hard not to like a company that continues to build its "reserve/land portfolio" and even with a 70% haircut to implied valuation, you're still looking at 100% upside - and that's with oil at $75.