Multi-Billion Dollar Oil Deal: Ovintiv Pays Up, Implying Significant Upside for Discounted Small-Cap Energy Equities

(Important Disclaimer at the Bottom)

Ovinitiv (NYSE: OVV) is acquiring oil and gas assets in the Permian Basin from three private companies backed by Encap, a private equity firm: Black Swan Oil & Gas, Petrolegacy Energy & Piedra Resources. Ovinitv is buying approximately 75,000 Boepd of production (80% liquids) and 65,000 net acres with an estimated 1,050 net undrilled well locations. The deal price is disclosed by Ovintiv as $4.275B, including $3.125B in cash and 32.6MM OVV shares.

Ovinitiv Acquisition and Implications

Ovintiv discloses that it is buying these Permian assets at $57K/Boepd, or 2.8x NTM EBITDA. Upon initial review, this transaction looks expensive compared to recent similar deals in the Permian, but the deal could make financial and strategic sense for Ovintiv as it extends Ovintiv’s low-cost inventory life by a few years.

The stock market seems to like the deal, and OVV shares rose 11.1% on the day of the announcement. Positive market reactions to acquisitions at rising multiples indicate that transaction values may continue to rise further as the cycle progresses, and bodes well for many smaller public companies trading at significantly lower valuations than those implied by these acquisitions.

The Deal is More Expensive Than It Looks

However, the deal price may be higher than it appears in transaction disclosures. Specifically, OVV’s simultaneous sale of a Bakken asset to Encap at a significantly lower-than-recent comparable transaction price implies foregone value by Ovintiv, which should be considered in this analysis. This implies an even higher Permian acquisition value, which means the transaction market may be even hotter than consensus expects.

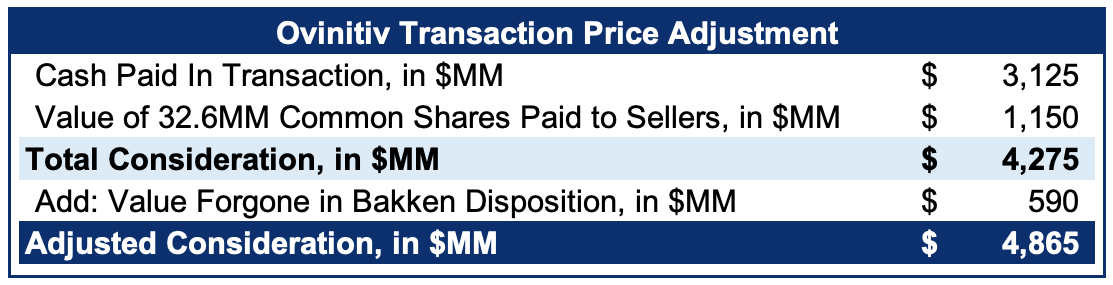

Let’s run through the numbers: Ovintiv sold its Bakken assets producing 37,000 Boepd (60% liquids) to Encap for $825 million, or $23K/Boepd. Six comparable transactions in the Bakken over the last 2 years indicate the transaction multiples should have been closer to $38K/Boepd. Assigning this price per flowing barrel multiple to Bakken assets implies $590MM of foregone value in this sale by Ovintiv. Adding this foregone value back to the purchase price of the Permian assets undoes this “Bakken Two Step” and gives a clearer picture, in our view, of the true transaction metrics:

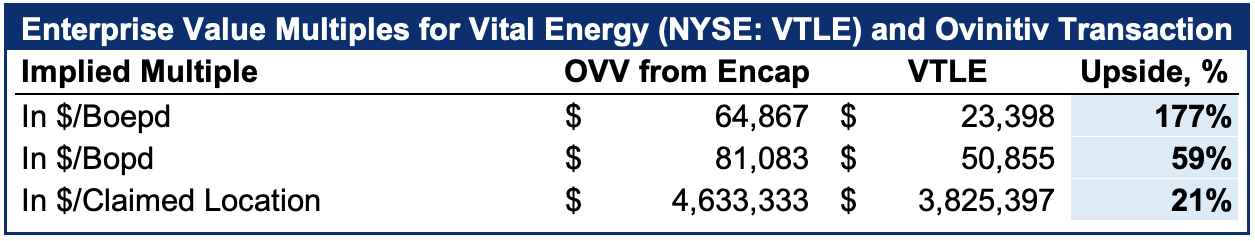

When adjusting for foregone value in the Bakken sale, it appears the Permian assets transacted closer ~$65K/Boepd, as can be seen below:

This is on the high end of recent transaction valuations on assets in the Permian, extending the trend of rising transaction prices. And it is meaningfully higher than the price implied in Ovinitiv’s press release.

Implications for Small-Cap Oil and Gas Equities

It is worth noting that there are still many publicly traded, smaller capitalization oil equities that are currently trading at much lower multiples than that implied in the Ovinitiv transaction, despite having similar assets. Accordingly, rising transaction multiples for oil and gas deals may catalyze a “re-valuation up” in these equities; either as investors become aware of this valuation disconnect or as larger capitalization companies acquire them for large premiums to their current trading price, while still achieving meaningful accretion. It is worth considering the trend of rising private acquisition valuations in this context, as eventually this valuation differential may have to yield:

An oil and gas M&A boom is on the horizon—if it isn’t already underway. As transactions multiples rise and the industry continues to consolidate, larger operators may soon take notice of the assets held by smaller publicly traded companies. In this environment, investors who bought shares in small cap oil and gas equities at low valuations may be richly rewarded.

Even if small cap oil & gas equities don’t see mass consolidation, these companies are still generating enormous free cash flow at current commodity prices. At the current pace, many are on track to buy back their entire market cap or pay enormous dividends to shareholders. And in either case, a stream of high-profile acquisition by large caps at a premium may galvanize higher multiples for the entire publicly traded peer set. In short, there are multiple paths to a successful investment outcome for small cap oil and gas investors at this junction, and this trend is already well underway.

Implications for Vital Energy

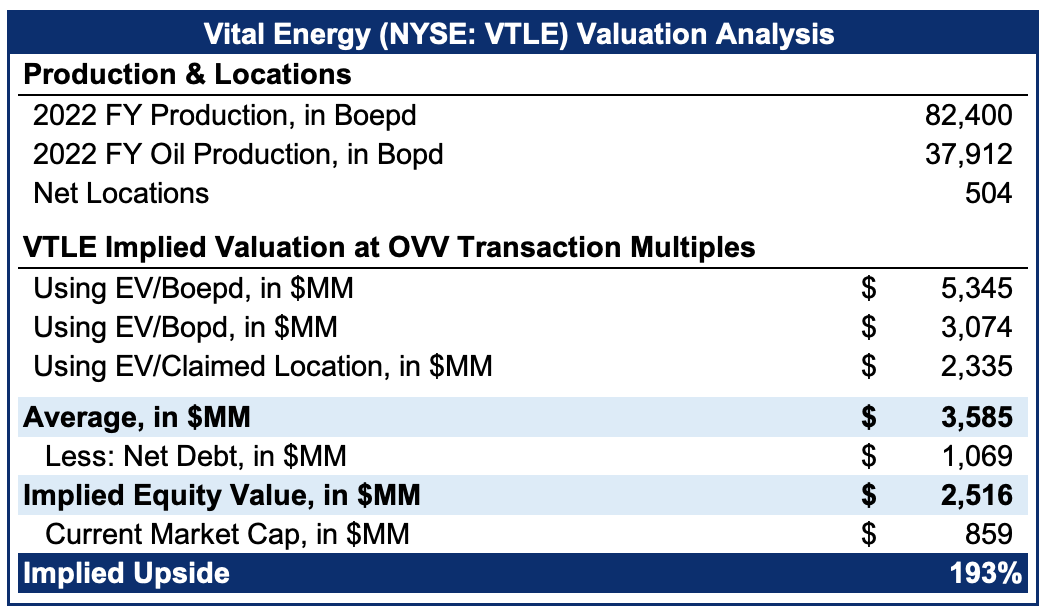

This recent transaction may also have implications for the liquidation value of a nearby publicly traded company, Vital Energy (NYSE: VTLE). Vital Energy is a ~84,000 Boepd Permian focused oil and gas producer, with assets near the ones Ovintiv just acquired:

Vital Energy Trades at a Substantial Discount

Like many O&G small caps, VTLE trades at a substantial discount to recent transaction multiples displayed above, as can be seen below:

This Ovintiv acquisition reads through nicely for Vital, implying upside of 200% or more to its current share price if it were to be acquired in similar transaction. Alternatively, it could trade up in the public market as its intrinsic value becomes better understood.

While the assets Ovintiv acquired come with more undeveloped well locations – some of which offer better well economics, the assets have been more aggressively recently developed, with as many as 7 rigs active on these lands recently. This implies a much higher decline rate and lower proportion of production to booked reserves, meaning a high reinvestment obligation to keep production flat. This compares unfavorably to Vital’s less aggressive recent development – 2 rigs active, lower production decline rate and lower stay-flat reinvestment rate. Vital’s significantly lower valuation may over-compensate for shortfalls and offer significantly more value for, on-balance, slightly inferior assets.

Below is an estimate of potential upside for VTLE shares in a buyout scenario:

As can be seen above, the Ovintiv/Encap transaction multiples are significantly above Vital’s current valuation. And irrespective of whether we value Vital’s production or drilling inventory using these multiples, it is too cheap to ignore—with ~200% upside in a potential buyout. These numbers are comfortably lower than Vital’s recently disclosed proved reserve “PV-10” value of $5.5 billion.

Despite offering compelling value, Vital’s highly productive and economic Howard County wells seem to be overlooked, likely due to operational hiccups in the back half of 2022. Having already recovered from these operational issues, Vital may now reward its investors as its discounted assets attract a potential acquirer, or as Vital re-rates in line with peers as its intrinsic value becomes better understood following this transaction.

Irrespective of whether Vital is bought out by a competitor or continues to operate on its own, the implication is that there is a clear line of sight to a successful outcome for VTLE holders. The rally in VTLE’s share price the day of the OVV announcement may mark an inflection.

Revaluation of Small Cap O&G Equities, Coming Soon?

Ovinitiv may have bought Encap’s Permian assets to extend inventory life and depth, but it’s disposal of Bakken assets at a low price implies a higher transaction multiple than what was announced. High, rising transaction multiples for these sized O&G assets are bullish for small cap oil and gas producers.

Incredibly, many of these still trade much cheaper than the price implied by this transaction, which is just the latest in a series of increasingly richly priced oil & gas asset acquisitions. This trend may force share prices for smaller cap O&G equities higher, through premium buyouts or broader market recognition of this value dislocation. Even if premium buyouts of publicly traded E&P’s don’t return, business is booming for small cap oil producers at current commodity prices, offering accretion and shareholder return opportunities in the form of buybacks and dividends.

Important Disclaimer: Opinions expressed herein by the author are not an investment recommendation and are not meant to be relied upon in investment decisions. The author is not acting in an investment adviser capacity. This is not an investment research report. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC or CSA filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable but have not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice. The author and funds the author advises owns shares of Vital Energy (NYSE: VTLE), and may buy or sell shares without any further notice.

Wonderful walk-through. Many thanks for the terrific work!

Thanks for the insight Josh.