OPEC+ recently announced another production quota increase of 548,000 barrels per day (bbl/d) for August. This marks the fourth consecutive monthly hike, bringing the cumulative announced increase to 1.8 million bbl/d since April. Despite this increase, the WTI crude price is up over 10% since OPEC+ began these announcements. So what explains the disconnect between more potential supply and higher prices?

1. Announced Increases Overstate Actual New Supply

The announced production increases are quotas, not actual production. Some OPEC+ members are already producing above their quotas, while others are underproducing and may struggle to meet the increased quotas, which dilutes the effect of any announced change.

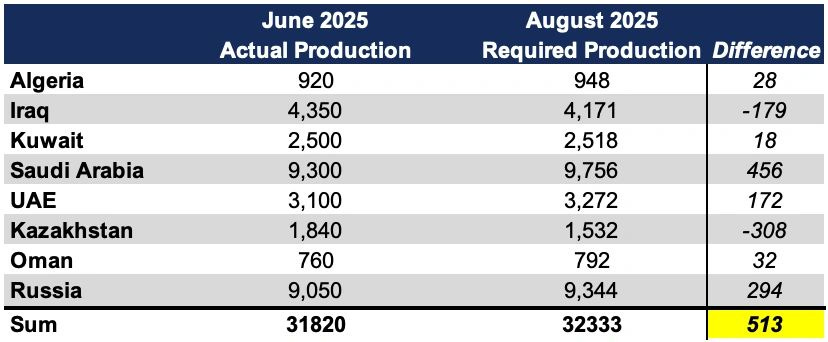

In the table above, it is clear that:

Iraq and Kazakhstan are both already producing well above their final August quotas. Their quota “increases” are unlikely to result in real additional barrels.

Russia produced roughly 100,000 bbl/d below its June 2025 quota, according to EIA data. Aging and damaged oil infrastructure may prevent Russia from reaching its August OPEC+ quota target. If that shortfall continues, this could remove as much as 294,000 bbl/d from the expected August increase.

While OPEC+ quota production for August totals 32.3 million bbl/d, actual production in June was already 31.8 million bbl/d. If Russia is unable to meet its future quotas, the additional physical barrels coming online may be much lower than the August target.

2. Spare Capacity Is Quietly Shrinking

With most of OPEC+’s prior cuts now reversed, nearly 2 million bbl/d of paper spare capacity has effectively been removed from the market. At the same time, OPEC+ appears to be shifting how it presents quotas. In a recent podcast interview, a Kpler analyst close to OPEC noted that the group is now referring to the new levels as “production ceilings” rather than “required production,” implying that these targets represent maximum capacity rather than typical output.

This reframing matters, because if these levels are in fact close to maximum sustainable output, it implies OPEC+ may have minimal true spare capacity left. This would remove millions of barrels per day of potential production from OPEC+ and would dramatically tighten oil market perceptions.

3. Saudi Behavior Signals Tight Market Conditions

Most of the real increase in barrels is expected to come from Saudi Arabia, and they recently raised their Official Selling Price (OSP) for Arab Light crude to $2.20 above the Oman/Dubai average. This is a strong signal of underlying market tightness. Given Saudi Arabia’s proximity to key buyers and access to real-time demand data, their pricing decisions are a useful indicator of how tight the market really is.

4. U.S. Drilling Activity Is Falling

U.S. rig counts are falling sharply.

Market pessimism and lower oil prices have led analysts to project that U.S. oil production could flatten or decline heading into 2026. The longer prices stay low, the more drilling slows—especially for high-cost offshore projects. This sets the stage for future supply shortfalls, while lower prices simultaneously stimulate demand by encouraging increased consumption. That consumption tends to be sticky, as behaviors like purchasing gas powered or less fuel-efficient vehicles keeps oil demand higher even after prices rise.

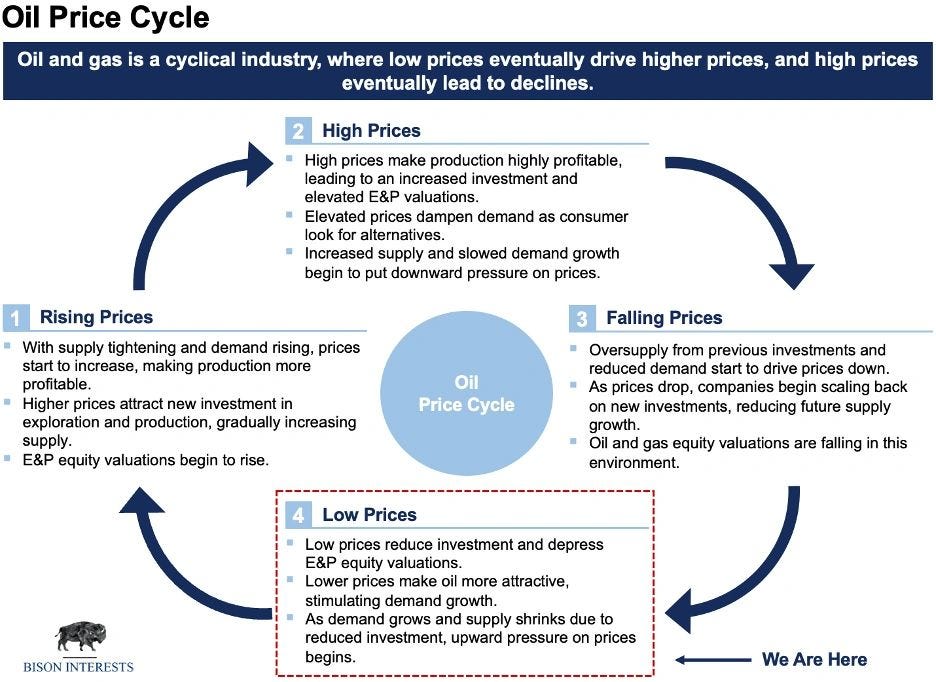

Conclusion: The lower prices go now, the higher—and higher for longer—they go later.

This is the classic oil market cycle: low prices today suppress investment, which leads to tighter supply tomorrow. While it’s possible that oil prices remain muted in the short term, the structural setup increasingly favors higher prices in the next 1–3 years.

The short term bearish case—where supply temporarily outpaces demand—sets up a more violent rebound later. Underinvestment today means that if demand picks up or supply falters, the resulting price spike could be sharp, and historically, investing in oil securities during periods of low prices has led to the greatest subsequent returns.

Opportunity: Higher oil prices and undersupply could rerate oil and gas equities

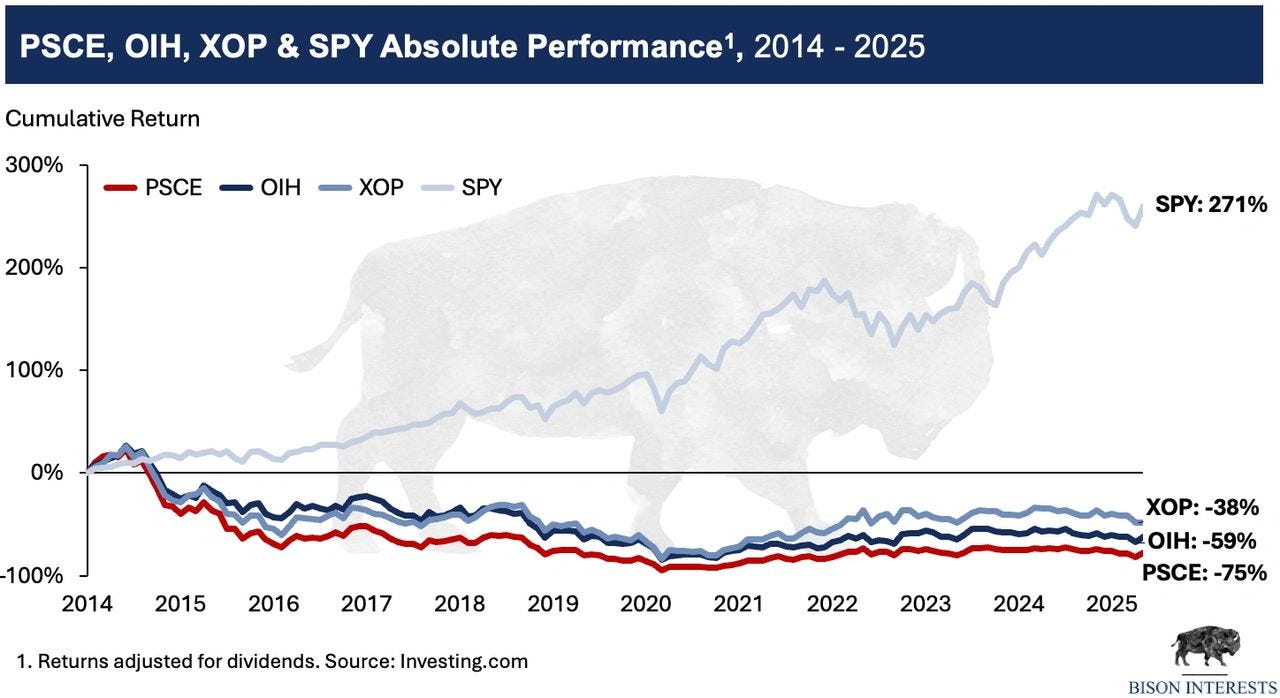

Oil equities have significantly underperformed the broader market since 2014, creating meaningful potential for outperformance in a sustained bull cycle.

Small-cap and oilfield services stocks, in particular, remain deeply discounted despite playing a critical role in directing capital toward the supply growth needed to rebalance the market. Historically, these segments have led late-cycle rallies, and with valuations at depressed levels, a mean reversion to the upside could drive substantial returns, even if they only catch up to large-cap performance.

Media Update

In June, Josh was featured on the In The Money podcast, where he shared his perspectives on recent M&A and shareholder activism, as well as our shift from natural gas to oil exposure. Later in the month, Josh was hosted on CNBC’s Squawk Box, where he discussed geopolitical risks to oil supply and shared his outlook on market fundamentals.

We also released a podcast version of our recent research piece, Pivoting From Natural Gas to Oil Equities. The podcast reviews our successful late-2024 natural gas call and outlines the rationale behind our recent shift toward oil-focused equities.

Disclaimer

This note does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities. Any such offer or solicitation will be made in accordance with applicable securities laws.

The note is being provided on a confidential basis solely to those persons to whom this monthly note may be lawfully provided. It is not to be reproduced or distributed to any other persons (other than professional advisors of the persons receiving these materials). It is intended solely for the use of the persons to whom it has been delivered and may not be used for any other purpose. Any reproduction of the monthly note in whole or in part, or the disclosure of its contents, without the express prior consent of Bison Interests, LLC (the “Company”) is prohibited.

No representation or warranty (express or implied) is made or can be given with respect to the accuracy or completeness of the information in the monthly note. Certain information in the monthly note constitutes “forward-looking statements” about potential future results. Those results may not be achieved, due to implementation lag, other timing factors, portfolio management decision-making, economic or market conditions or other unanticipated factors. Nothing contained herein shall be relied upon as a promise or representation whether as to past or future performance or otherwise.

The views, opinions, and assumptions expressed in this note as of July 2025 are subject to change without notice, may not come to pass and do not represent a recommendation or offer of any particular security, strategy or investment.

The note does not purport to contain all of the information that may be required to evaluate the matters discussed therein. It is not intended to be a risk disclosure document. Further, the note is not intended to provide recommendations, and should not be relied upon for tax, accounting, legal or business advice. The persons to whom this document has been delivered are encouraged to ask questions of and receive answers from the general partner of the Company and to obtain any additional information they deem necessary concerning the matters described herein.

None of the information contained herein has been filed or will be filed with the Securities and Exchange Commission, any regulator under any state securities laws or any other governmental or self-regulatory authority. No governmental authority has passed or will pass on the merits of this offering or the adequacy of this document. Any representation to the contrary is unlawful.

Thank you for an honest evaluation of these numbers - OPEC+ and more.