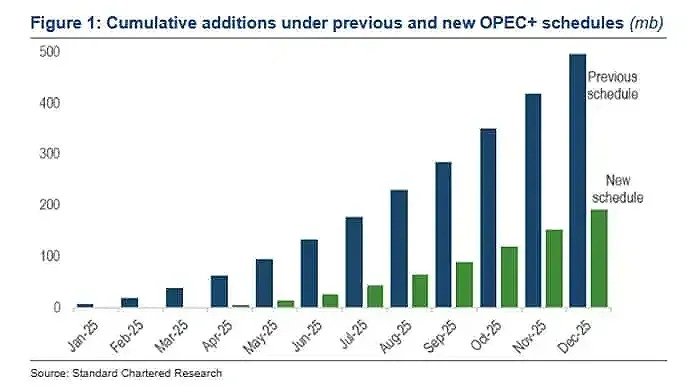

OPEC recently extended its production cuts by three months to April 2025 and termed out the unwinding of the cuts to 2026, effectively removing 305 million barrels of cumulative production, or 0.84 million barrels per day (mbd), from the 2025 oil market.

Despite this reduction, WTI has remained relatively flat, hovering near three-year lows, as the prevailing sentiment suggests an oversupplied oil market in 2025.

We disagree. The oil market experienced nearly a 1 mbd deficit in 3Q24, rig counts are down 6% year-over-year, and oil majors Chevron and Shell have recently announced capital expenditure cuts, reflecting the industry’s shift toward shareholder returns over growth. As a result, non-OPEC production growth is not expected to meet 2025 demand (according to EIA projections), leaving OPEC to fill the gap. Bears may argue that OPEC has ample spare capacity, but spare capacity is not the same as actual production and overlooks the more important factor: OPEC’s pricing strategy.

OPEC has the ability to adjust its production levels to maintain or raise global oil prices. Due to high production growth from the U.S., Canada, and Guyana over the past three years, OPEC has chosen to cut output to support prices. This dynamic is likely approaching an inflection point, as non-OPEC growth is projected to fall short of meeting 2025 global demand. This will create a call on OPEC, making consumers reliant on OPEC barrels to balance the market.

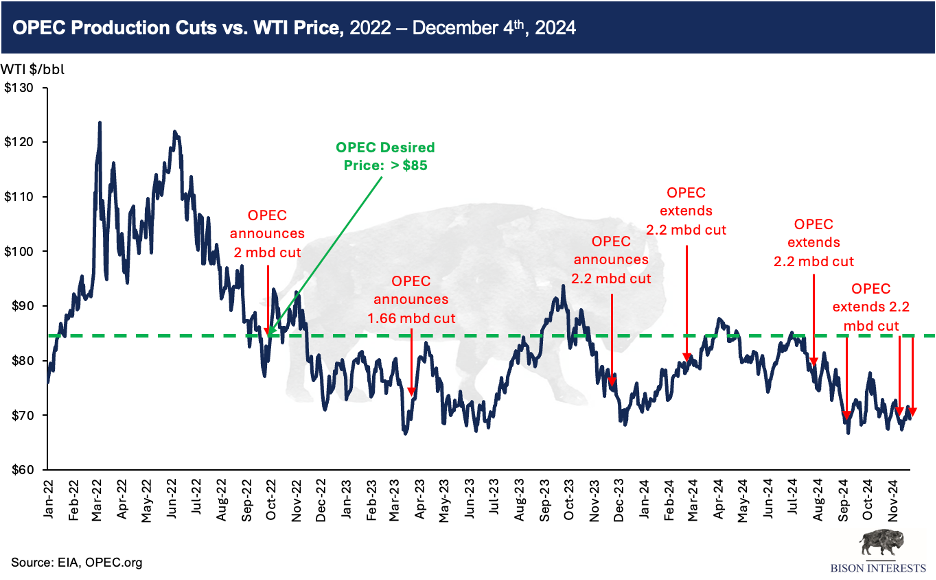

The call on OPEC will give the group leverage to set prices by allowing them the option to withhold barrels to drive up oil prices. This raises the question: what price is OPEC aiming for? While the group has never explicitly stated a target, their intentions are evident from previous cuts and extensions, including at prices as high as $85 WTI—significantly higher than current levels. Also notable, Saudi Arabia, OPEC's largest member, requires an oil price of $96 to balance its budget, underscoring the group's incentive to push for higher prices.

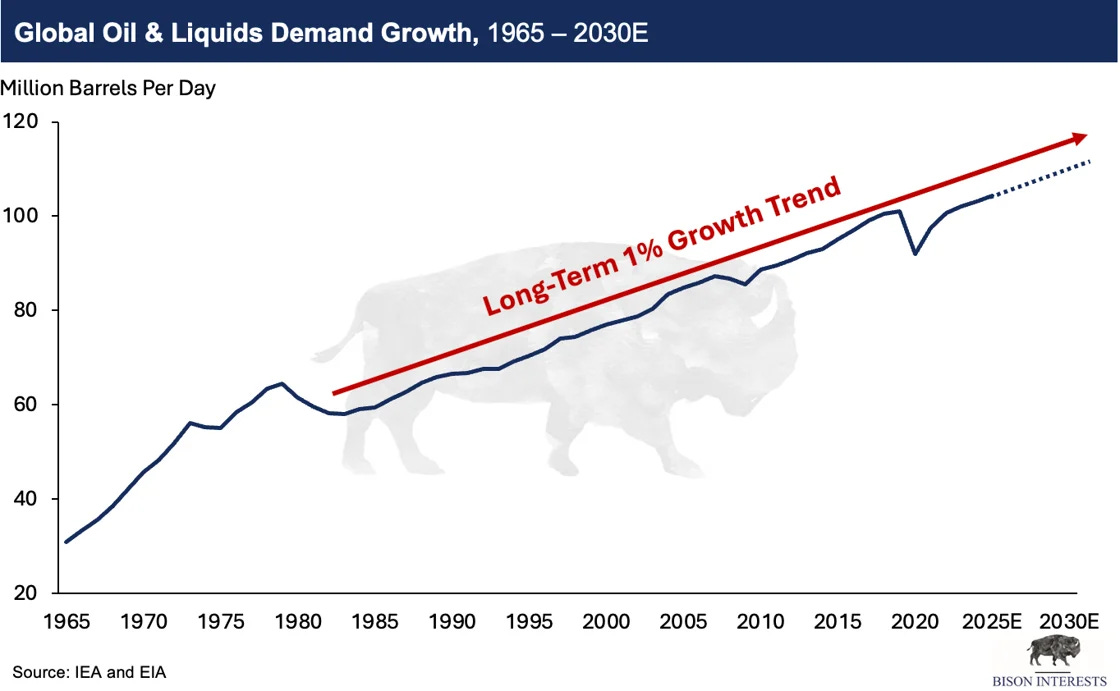

Shifting market dynamics are giving OPEC greater leverage, and beyond 2025, we expect OPEC’s influence to grow as rising global demand continues to increase. Ultimately, exhaustion of OPEC spare capacity could lead to much higher pricing in the future if this longer term demand trend continues.

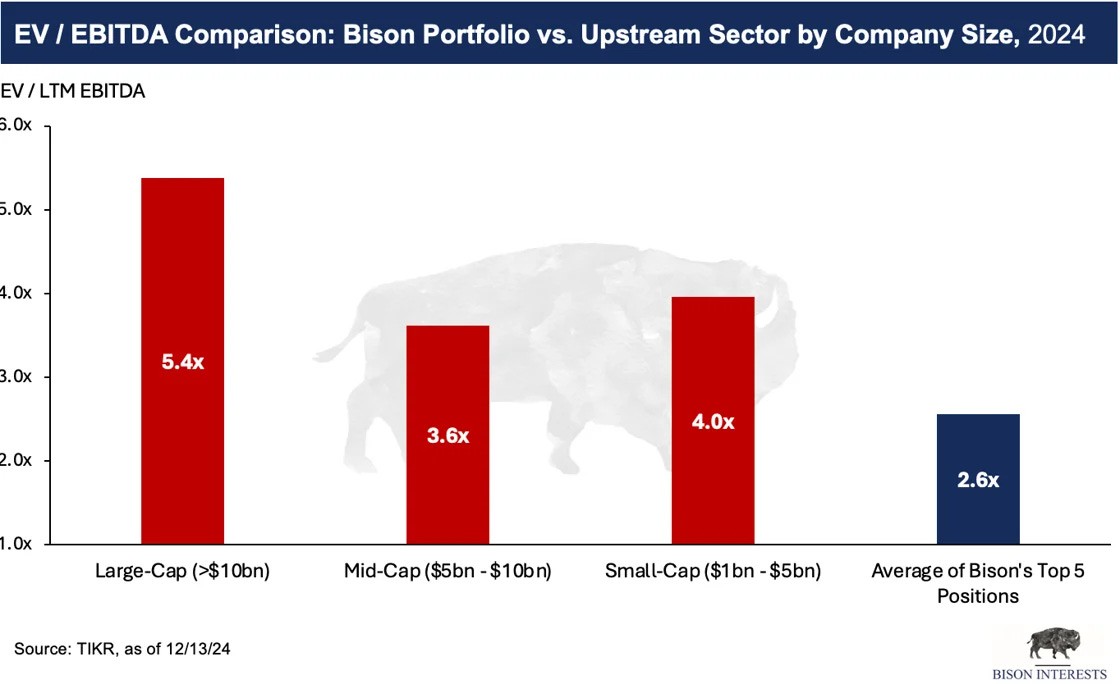

We think this trend is poised to create highly favorable conditions for oil producers next year and through the end of the decade. Our portfolio is aligned with this thesis, and we believe the companies we’re invested in are deeply undervalued, even compared to the other already discounted small to mid-cap equities.

In a rising commodity price environment, undervalued oil and gas companies benefit from a dual effect: higher intrinsic values and multiple expansion as their valuations revert to industry standard levels. Oil and gas is a cyclical industry, and with prices currently low and companies announcing reduced capital expenditures for 2025, we believe we’re closer to the bottom of the cycle than the top. As a result, we’re excited about this opportunity to capitalize on the current low pricing and valuation environment.

Media Update

In November, our CIO, Josh Young, made two media appearances. First, Josh joined the Digital Wildcatters Podcast to share his background, his entry into the oil and gas sector, and strategies for outperforming the market. Later in the month, Josh appeared on the Oil Ground Up podcast, where he analyzed OPEC’s strategies and discussed the impact of political changes on energy policy, including the potential implications of a Trump administration return.

More recently, Josh participated in a Bull vs. Bear Debate with Paul Sankey on ZeroHedge and shared his oil market outlook with Jimmy Connor on Bloor Street Capital.

Disclaimer

The note does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities. Any such offer or solicitation will be made in accordance with applicable securities laws.

The note is being provided on a confidential basis solely to those persons to whom this monthly note may be lawfully provided. It is not to be reproduced or distributed to any other persons (other than professional advisors of the persons receiving these materials). It is intended solely for the use of the persons to whom it has been delivered and may not be used for any other purpose. Any reproduction of the quarterly note in whole or in part, or the disclosure of its contents, without the express prior consent of Bison Interests, LLC (the “Company”) is prohibited.

No representation or warranty (express or implied) is made or can be given with respect to the accuracy or completeness of the information in the quarterly note. Certain information in the monthly note constitutes “forward-looking statements” about potential future results. Those results may not be achieved, due to implementation lag, other timing factors, portfolio management decision-making, economic or market conditions or other unanticipated factors. Nothing contained herein shall be relied upon as a promise or representation whether as to past or future performance or otherwise.

The views, opinions, and assumptions expressed in this note as of December 2024 are subject to change without notice, may not come to pass and do not represent a recommendation or offer of any particular security, strategy or investment.

The note does not purport to contain all of the information that may be required to evaluate the matters discussed therein. It is not intended to be a risk disclosure document. Further, the note is not intended to provide recommendations, and should not be relied upon for tax, accounting, legal or business advice. The persons to whom this document has been delivered are encouraged to ask questions of and receive answers from the general partner of the Company and to obtain any additional information they deem necessary concerning the matters described herein.

None of the information contained herein has been filed or will be filed with the Securities and Exchange Commission, any regulator under any state securities laws or any other governmental or self-regulatory authority. No governmental authority has passed or will pass on the merits of this offering or the adequacy of this document. Any representation to the contrary is unlawful.

Great and insightful article. Long on oil service companies - doing more with less. Once the undersupply is realized, long on oil producers, especially those with positions in West Texas.

how does trump policy “drill baby drill” affects the markets . Isn’t that bearish for oil market ?