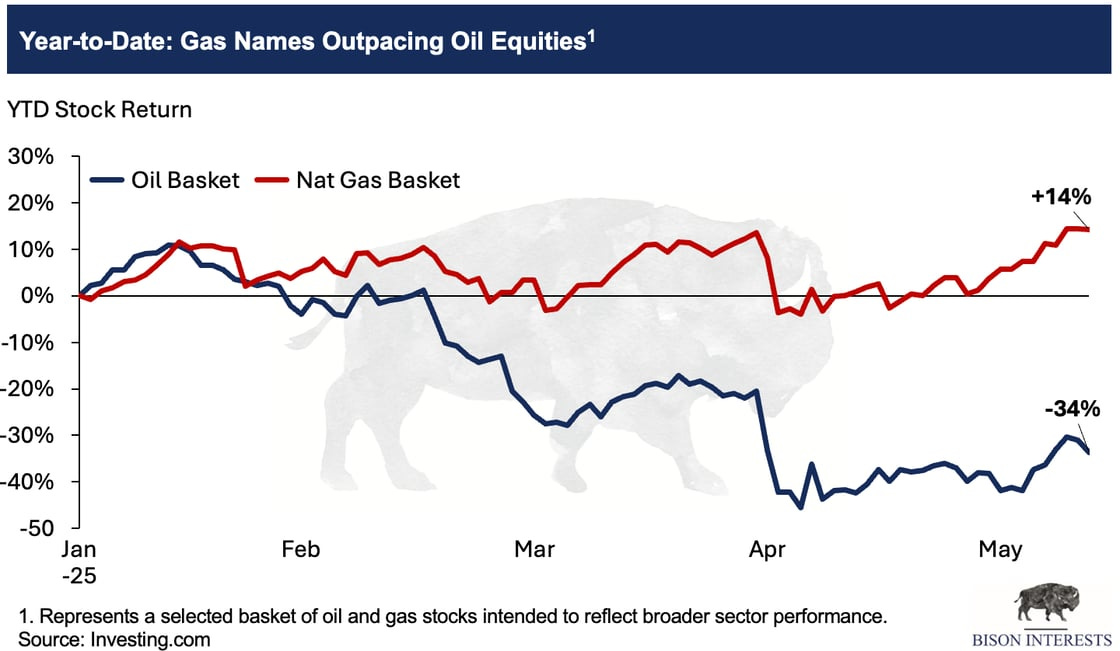

Earlier this year, we highlighted our bullish view on natural gas equities. Since then, gas producers have meaningfully outperformed their oil-focused peers.

On the oil side, sentiment appears to be amazingly bearish – roughly as bearish as when oil prices went negative at the beginning of COVID lockdowns. Funds are heavily underweight energy, particularly oil, reflecting widespread pessimism around future pricing.

From a purely technical standpoint, this kind of positioning is a bullish signal. When most capital is concentrated on the bearish side, downside risk tends to be limited simply because there's less selling left to do, and upside potential is more pronounced, given the bigger potential rebound as capital shifts back in. And because oil prices and equities are cyclical by nature, sentiment has always historically reversed over time.

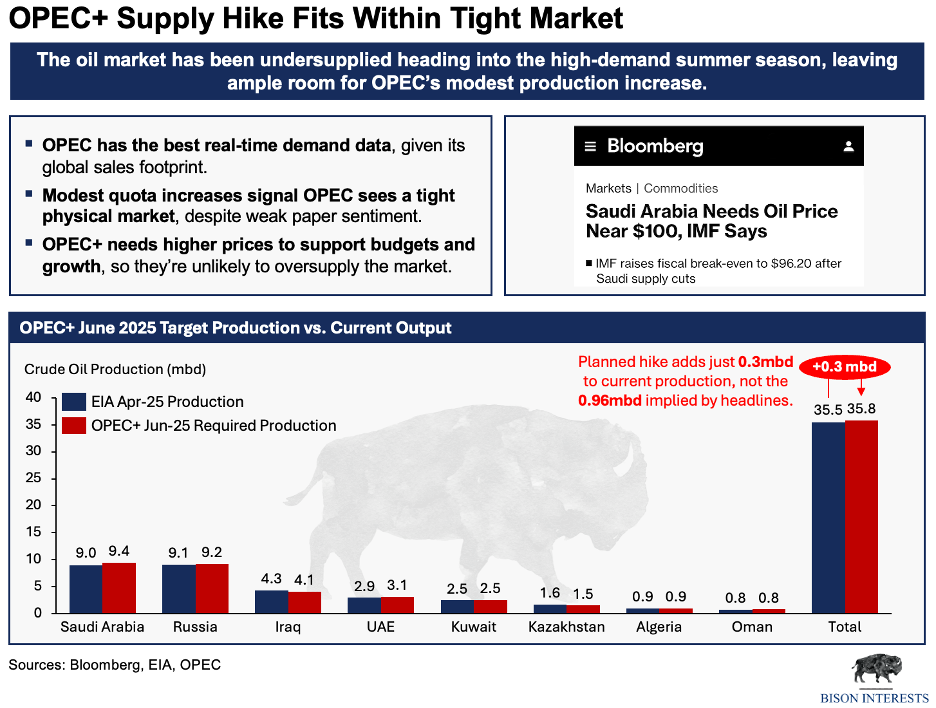

Sentiment is currently negative due to concerns about oversupply following the recent unwinding of OPEC+ cuts, with news outlets suggesting an additional 960,000 bpd will come online across April, May, and June. However, when comparing actual production data from the EIA to the new OPEC+ targets, the real increase appears to be closer to 300,000 bpd. The difference is largely due to overproduction by certain member countries—mainly Iraq and Kazakhstan—reducing the amount of new supply that will actually hit the market.

Market participants also appear to be overestimating non-OPEC production growth, which is likely to slow meaningfully in a lower oil price environment. This slowdown may already be underway, as indicated by recent commentary from U.S. producers and the continued decline in rig counts and frac spread activity.

At the same time, oil inventories are near five year lows, reflecting a tight physical market. With limited spare supply available, the market has less capacity to absorb unexpected disruptions, making prices more sensitive to even modest changes in supply or demand.

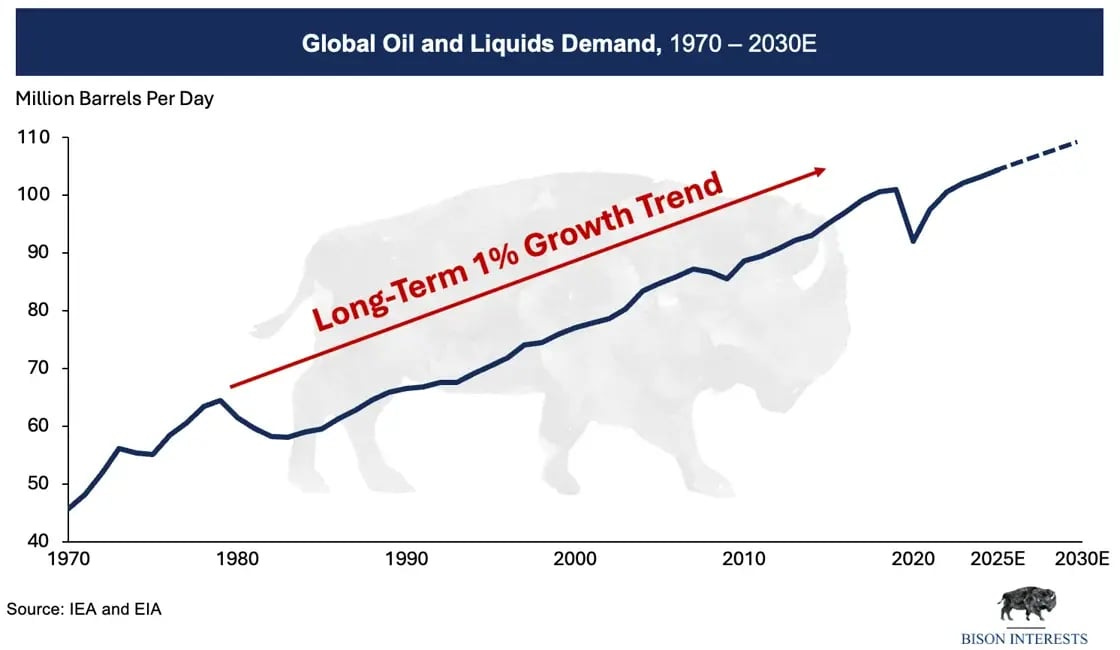

Over the longer term, the industry has underinvested in oil and gas exploration and development. Low prices and investor pressure to prioritize returns over growth have led to a structural decline in spending.

This underinvestment has long-term implications for future supply and sets the stage for a multi year bull market if oil demand continues to rise at its average pace of 1% per year.

Media Update

In April, Josh visited a former portfolio company and was featured on their podcast, The Flowline, where he discussed the potential impact of newly announced tariffs, rising steel costs, and growing market uncertainty. He also shared thoughts on how these dynamics may affect oilfield activity, supply chains, and broader economic conditions, including risks tied to policy unpredictability and geopolitical tensions.

Disclaimer

This note does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities. Any such offer or solicitation will be made in accordance with applicable securities laws.

The note is being provided on a confidential basis solely to those persons to whom this monthly note may be lawfully provided. It is not to be reproduced or distributed to any other persons (other than professional advisors of the persons receiving these materials). It is intended solely for the use of the persons to whom it has been delivered and may not be used for any other purpose. Any reproduction of the monthly note in whole or in part, or the disclosure of its contents, without the express prior consent of Bison Interests, LLC (the “Company”) is prohibited.

No representation or warranty (express or implied) is made or can be given with respect to the accuracy or completeness of the information in the monthly note. Certain information in the monthly note constitutes “forward-looking statements” about potential future results. Those results may not be achieved, due to implementation lag, other timing factors, portfolio management decision-making, economic or market conditions or other unanticipated factors. Nothing contained herein shall be relied upon as a promise or representation whether as to past or future performance or otherwise.

The views, opinions, and assumptions expressed in this note as of May 2025 are subject to change without notice, may not come to pass and do not represent a recommendation or offer of any particular security, strategy or investment.

The note does not purport to contain all of the information that may be required to evaluate the matters discussed therein. It is not intended to be a risk disclosure document. Further, the note is not intended to provide recommendations, and should not be relied upon for tax, accounting, legal or business advice. The persons to whom this document has been delivered are encouraged to ask questions of and receive answers from the general partner of the Company and to obtain any additional information they deem necessary concerning the matters described herein.

None of the information contained herein has been filed or will be filed with the Securities and Exchange Commission, any regulator under any state securities laws or any other governmental or self-regulatory authority. No governmental authority has passed or will pass on the merits of this offering or the adequacy of this document. Any representation to the contrary is unlawful.

These reports are helpful. Thanks for your time.