A large Canadian infrastructure company is buying the Pipestone gas plant, in a transaction that stipulates plant expansion. The likely expansion of the Pipestone gas plant unlocks value for Pipestone Energy (TSX: PIPE) by providing future capacity for highly economic production growth, leading to a likely higher production plateau and more free cash flow in the medium term.

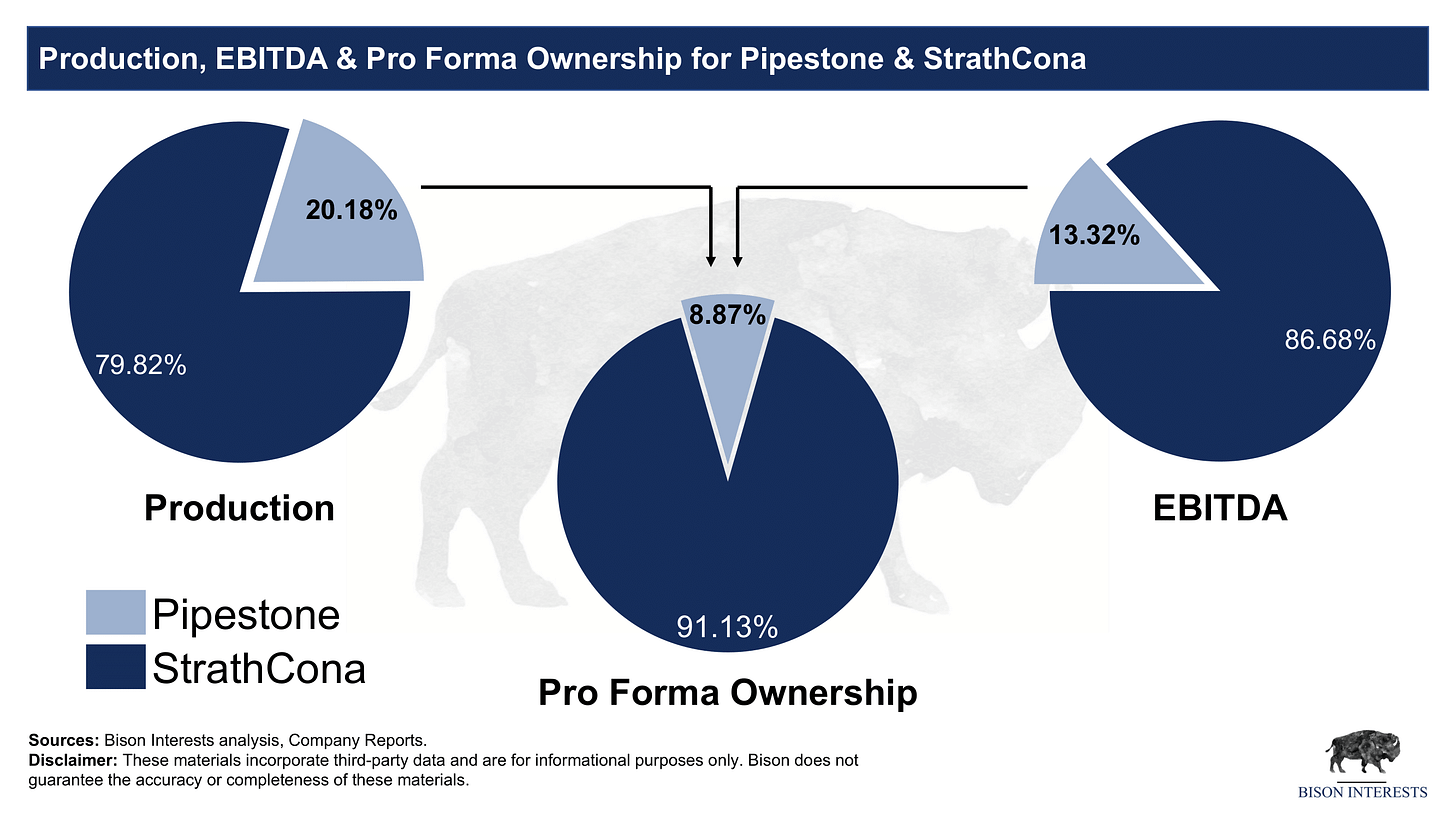

Pipestone gas plant expansion increases the viability of Pipestone Energy as a standalone entity, increasing the likelihood of a higher offer that allocates value more fairly than the Strathcona proposal:

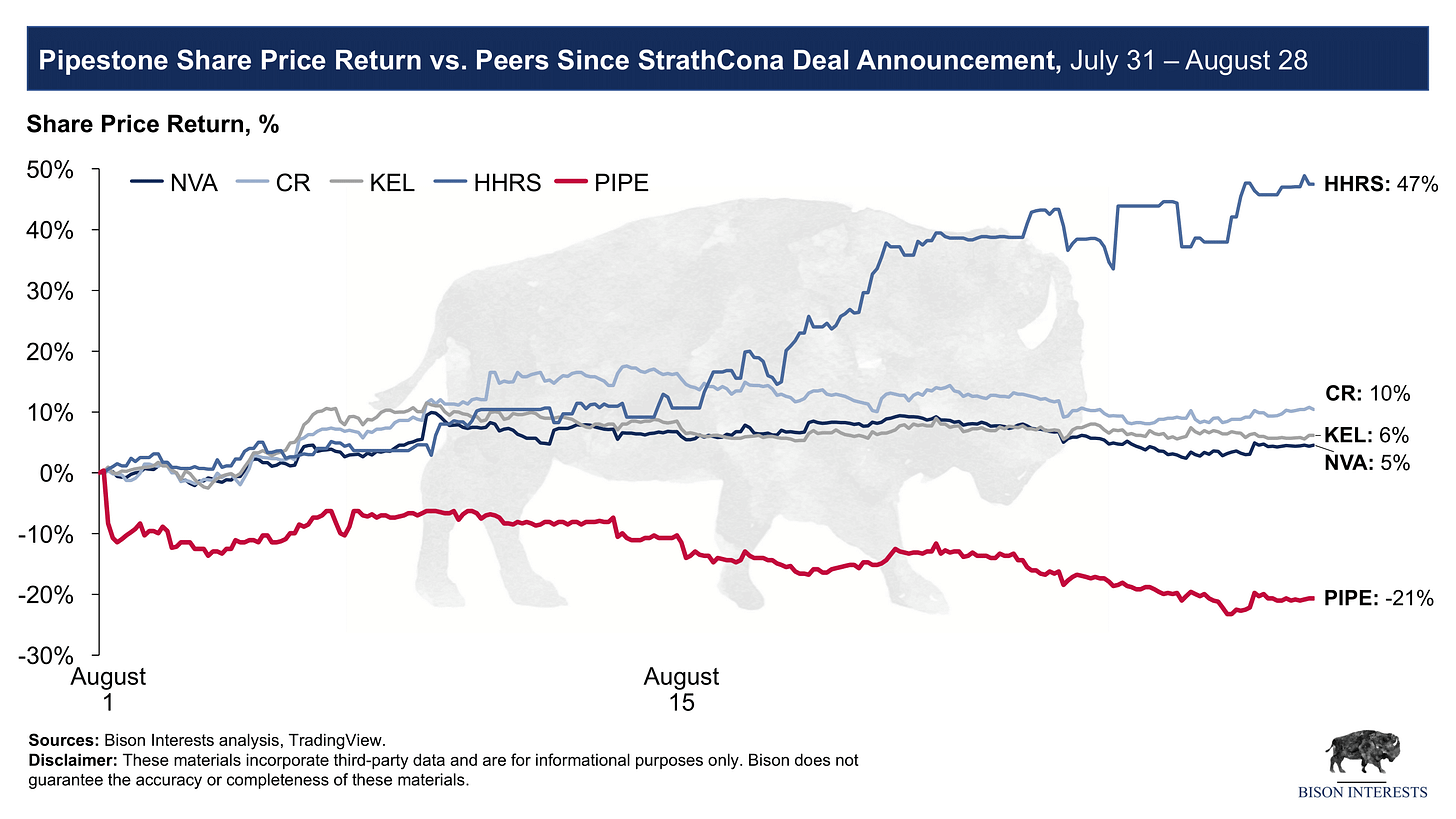

Pipestone’s shares had meaningfully underperformed peers since the announcement of the proposed Strathcona transaction, which we interpret as the market pricing in a bad deal:

This share price underperformance, along with Pipestone’s heavily discounted valuation versus peers and recent asset transactions, may be corrected by the Pipestone gas plant transaction and potentially a subsequent higher offer or shareholder rejection of the Strathcona proposed deal.

Pipestone Gas Plant Transaction Analysis & Implications

AltaGas Ltd. (TSX: ALA) entered into an agreement with Tidewater Midstream (TSX: TWM) to purchase several midstream assets, including the Pipestone natural gas processing plant, phase 2 expansion project, natural gas storage facility, condensate terminal, and associated gathering pipeline systems. The deal is subject to FID on the gas plant expansion project (essentially, the deal is subject to the expansion project going forward, and a joint venture has been formed for that purpose).

The total consideration for these assets is $650MM, estimated to be 8.5x EBITDA, or 7.2x EBITDA pro forma for the expansion of the Pipestone plant. It is considered strategic and accretive to Altagas, while de-levering Tidewater. The acquisition is both contractually and economically contingent on the phase 2 plant expansion, which is promising for area operators like Pipestone.

This gas plant deal improves pre-deal growth expectations for Pipestone, which had been reflected in consensus estimates but were heavily discounted in the market and company guidance, likely due to concerns about the ability to gather and process production volumes. Pipestone’s shares were already discounted versus peers prior to the plant sale, while production was projected to grow faster:

The processing plant transaction improves Pipestone’s economic prospects, increasing its standalone value. The value increase improves the odds of Pipestone shareholders voting against the Strathcona deal. More visibility on more production growth and higher steady-state free cash flow makes Pipestone more compelling to other potential buyers as well. The stock price reacted positively to the announcement, perhaps starting to price in these considerations:

Conclusion/Takeaways

Pipestone’s substantial share price underperformance since the Strathcona proposed deal announcement, coupled with Pipestone’s improved economic prospects following this midstream deal, increases the chances of a superior deal. Even if no competing offer is brought to the table, Pipestone could perform well in public markets if it remained independent, with expanded growth prospects and a heavily discounted valuation versus public peers and recent Montney asset transactions.

Important Disclaimer: Opinions expressed herein by the author are not an investment or vote recommendation and are not meant to be relied upon in investment or voting decisions. The author is not acting in an investment adviser capacity. This is not an investment research report. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC or CSA filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable but have not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice. Funds the author advises owns shares in Pipestone Energy (TSX: PIPE) and may buy or sell shares without any further notice. This is not a solicitation or recommendation to vote for or against the transaction discussed.

The note does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities. Any such offer or solicitation will be made in accordance with applicable securities laws.

The note is being provided on a confidential basis solely to those persons to whom this quarterly note may be lawfully provided. It is not to be reproduced or distributed to any other persons (other than professional advisors of the persons receiving these materials). It is intended solely for the use of the persons to whom it has been delivered and may not be used for any other purpose. Any reproduction of the quarterly note in whole or in part, or the disclosure of its contents, without the express prior consent of Bison Interests, LLC (the “Company”) is prohibited.

No representation or warranty (express or implied) is made or can be given with respect to the accuracy or completeness of the information in the quarterly note. Certain information in the monthly note constitutes “forward-looking statements” about potential future results. Those results may not be achieved, due to implementation lag, other timing factors, portfolio management decision-making, economic or market conditions or other unanticipated factors. Nothing contained herein shall be relied upon as a promise or representation whether as to past or future performance or otherwise.

The views, opinions, and assumptions expressed in this note as of September 2023 are subject to change without notice, may not come to pass and do not represent a recommendation or offer of any particular security, strategy or investment.

The note does not purport to contain all of the information that may be required to evaluate the matters discussed therein. It is not intended to be a risk disclosure document. Further, the note is not intended to provide recommendations, and should not be relied upon for tax, accounting, legal or business advice. The persons to whom this document has been delivered are encouraged to ask questions of and receive answers from the general partner of the Company and to obtain any additional information they deem necessary concerning the matters described herein.

None of the information contained herein has been filed or will be filed with the Securities and Exchange Commission, any regulator under any state securities laws or any other governmental or self-regulatory authority. No governmental authority has passed or will pass on the merits of this offering or the adequacy of this document. Any representation to the contrary is unlawful.

"The value increase improves the odds of Pipestone shareholders voting against the Strathcona deal" How come?