Rebound in the Freight Market: Oil Market Recession Fears Were Exaggerated

(Important Disclaimer at the Bottom)

In Bison’s May 2023 white paper, Recession Fears Mean Opportunity In The Oil Market, we argued that while oil market sentiment was very negative, multiple market indicators were less negative than popularly portrayed. We identified this disconnect between fundamentals and sentiment as a potentially promising entry point. Oil prices and related equities have subsequently rebounded, and we are still finding value in small-cap oil & gas equities.

Rebounding Freight Market Improving Oil Demand

One likely driver of the rebound in oil prices is the rebound in the freight market, which we highlighted as a driver of tepid oil demand in our May white paper:

“While analysts ponder the risk of a broader recession that could negatively impact oil demand, it is easy to miss that a shipping and trucking recession is already underway. This recent slump in freight demand has put pressure on diesel demand, an oil product:

Transportation activity is a key indicator used in predicting and evaluating economic downturns. Considering the decline in freight activity for nearly a year now it is possible that we’re nearing the end of that aspect of the recession, and the oil demand weakness that has been prominently featured in oil market headlines and forecasts.

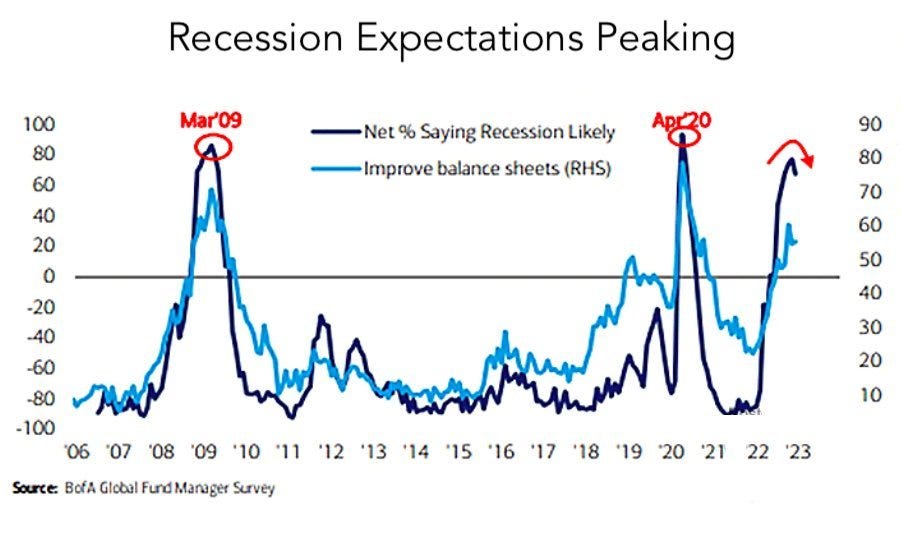

Oil and diesel appear to already be pricing in this massive decline in freight activity. While it is difficult to tell when freight demand will stabilize and recover, recent improvements in US retail sales data are promising while recession expectations are peaking:

Many analysts and news headlines had missed this important driver of oil demand while focusing their attention elsewhere. We received pushback against our argument that the freight market’s decline may be nearing a reversal that could improve oil demand and oil prices.

Freight Activity Rebound: Recession Postponed?

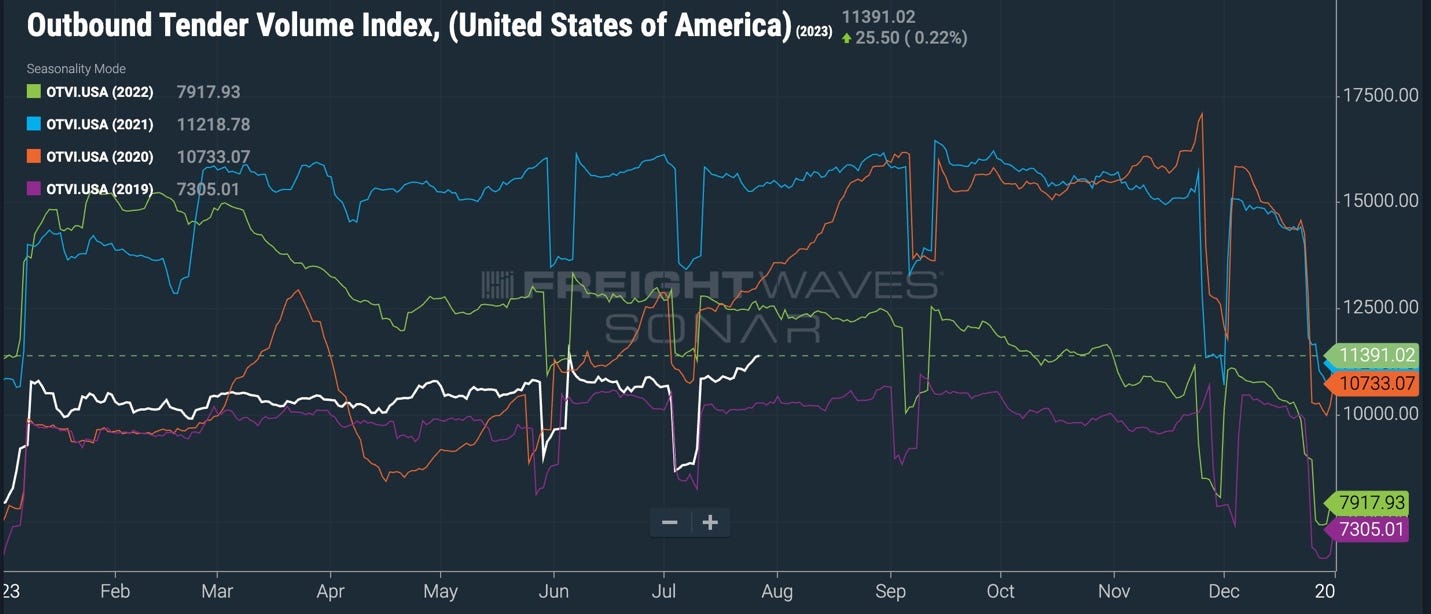

Pessimistic sentiment tends to peak as recoveries begin. Several months after we called a possible bottom of the freight recession, we may have been vindicated as freight volume has been on an improving trajectory heading into the 2nd half of the year:

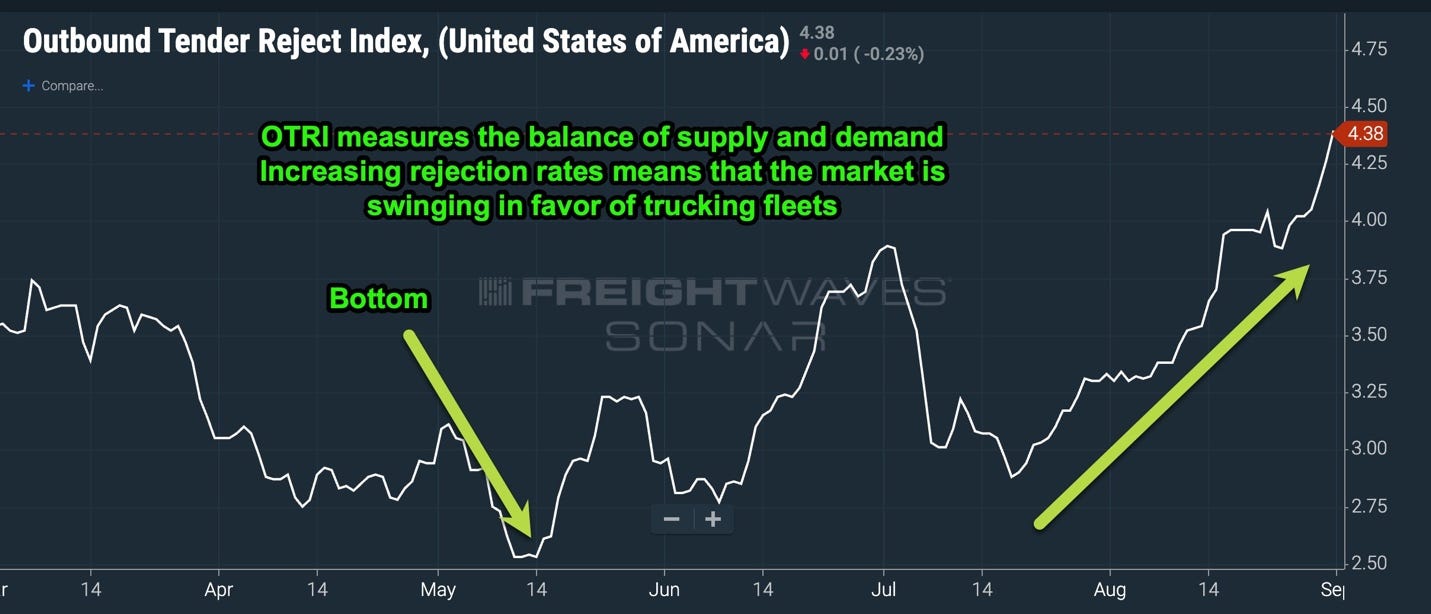

The Freight Waves outbound tender rejection index (OTRI) measures a truckload carrier’s willingness to accept loads that are tendered by shippers. When the index is rising a larger percentage of the loads being tendered are rejected by truckers, either due to a lack of capacity or low pricing[1]. The OTRI index soared recently:

The potential impact of a rapidly improving freight market could have on oil prices cannot be overstated, and few market participants seem to understand the implications. Commercial transportation makes up a substantial portion of global oil demand, and the effects of an accelerating freight market paired with declining incremental supply could have a dramatic effect on prices in the last quarter of 2023 and into 2024.

Additionally, the freight market is an important gauge of economic health and has historically been a reasonably accurate leading indicator of recessions. With the freight bear market potentially in the rear-view, it appears reasonably likely that the recession and associated oil demand destruction analysts have been predicting for over a year may be further delayed.

China Concerns Overblown

China recession concerns may also be overblown, which may intensify the freight recovery we described above. In our view, while secular economic growth in China will likely be slower than it has been historically, the Chinese economy is still undergoing cyclical improvement. China’s banking sector, for instance, isn’t reflecting the meltdown many analysts are describing:

The perceived China bust is unlikely to be contained to the real estate sector, which is undergoing a contained deleveraging following the collapse of developer Evergrande and other non-state-owned homebuilders. However, the Chinese economy did not experience the boom many analysts including Bison had anticipated following the lifting of its zero-covid policy, resulting in overly negative sentiment and news coverage.

China’s slow post-Covid recovery has allowed for slow growth despite its real estate market crisis. New car sales, a leading recession and consumer health indicator, are holding up well:

Source: MarkLines

China’s slow growth has implications for commodity markets. China is a major global importer of nearly all commodities, notably oil, for which it comprises ~13% of global demand. If China truly was undergoing a meltdown we would expect a collapse in commodity prices, which hasn’t been the case:

Implications for Oil and Gas Equities

With the freight recession subsiding, recession fears in China likely overblown, and US economic indicators better than expected, it appears that forward-looking oil and gas equities are beginning to rebound:

It is also worth highlighting the recent outperformance of small and mid-cap oil and gas equities, proxied by PSCE and XOP, respectively, versus large caps. As the oil cycle progresses and prices head higher due to future supply imbalances, smaller companies with more operating leverage and lower starting valuations may see more rapid improvements in fundamentals, potentially resulting in share price outperformance versus larger, less discounted companies’ shares.

The material valuation disconnect between small and large-cap oil equities means potentially more upside from valuation re-rating, with a margin of safety from lower starting valuations. We believe this makes smaller-cap oil & gas equities compelling here. Some of the recent outperformance may be explained by this phenomenon. As small-cap valuations re-rate to in line with large-cap peers as the cycle progresses, we see enormous potential upside from here in particularly compelling small-cap oil & gas equities.

Important Disclaimer: Opinions expressed herein by the author are not an investment recommendation and are not meant to be relied upon in investment decisions. The author is not acting in an investment adviser capacity. This is not an investment research report. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC and CSA filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Very helpful. Thank you