The fundamental setup for oil and related equities remains compelling due to steadily rising demand and supply disappointments due to underinvestment and policy constraints. However, oil prices languished in the back half of 2022 as China’s unexpected, extended zero-Covid lockdowns softened demand, potentially by as much as 3MM bbl/d.

Now that China is unwinding it’s zero-Covid policy, its economic activity is rebounding, and oil prices are on the move in response to rising demand. With higher interest in oil and associated equities, and having highlighted the disproportionate opportunity in smaller cap oil & gas equities in our 2023 Outlook, it is timely to share a portion of our investment thesis on a heavily discounted Bison portfolio position: Vital Energy (NYSE: VTLE).

Vital Energy is ~75,000 boe/d Permian focused E&P operating on 163,000 net acres. Vital’s share price has underperformed peers in the last year due to operational headwinds, production misses, and other issues:

In 2023, the newly rebranded company (formerly Laredo Petroleum) is quietly overcoming prior issues. And with its valuation still depressed, VTLE appears poised for comeback. The investment case for Vital is compelling as it trades at a material discount to cyclically cheap small cap Permian-focused peers and to its net asset value. Vital’s ultra-low valuation implies there may be upside from catching up to peer valuations even if oil prices stay flat, particularly as operations improve. At current commodity prices and with hedges in place, Vital is likely to generate more than a third of its market cap in free cash flow in 2023, offering multiple paths to a re-rate higher.

Company Background

The most likely driver of Vital’s underperformance is a series of production misses and subsequent lower production guidance in Q3 2022. Management had originally forecasted 39,500 - 42,500 bbl/d of oil production in 2022, but due to operational headwinds in the North Howard County and unforeseen (by management) cost inflation, production was lower than guidance throughout most of the year. Management was subsequently forced to lower its full year production guidance, and VTLE’s underperformance gap to peers began to widen.

North Howard County—Vital’s area of development focus—is highly desired for drilling due to fast payback periods on wells. Good economics have inevitably attracted competition from other producers, who are drilling wells near Vital’s. Nearby fracking activity may have caused frac hits on Vital’s existing long lateral wells, resulting in a temporary decline in well production and potentially driving production misses versus management’s expectations. Since Vital is a small company with most of its production concentrated in one area, total production is more sensitive to individual well underperformance than peers.

Operating Performance is Improving

The situation has since improved, with Vital having recorded better well performance for Q4 2022. Vital’s newer Howard county wells are more profitable than management expectations, with payback periods of less than 1 year. And Vital’s Leech long lateral wells, which were originally a cause of concern, appear on track for much better performance. Vital’s improving well performance remains underappreciated and offers upside to their production from here, while the market remains focused on previous production misses.

Despite producing more oil than the high end of management guidance in Q4 2022, Vital’s shares aren’t getting any credit, which presents an opportunity to invest in Vital at a steep discount ahead of broader market realization of operational recovery:

Valuation Upside

Collectively, small cap oil and gas equities remain heavily discounted versus large cap O&G equities and the broader market, and there is material upside potential for this group to re-rate in line with peers:

Remarkably, VTLE screens cheaply compared to low valuation peers, using consensus numbers. In our view, this discount is not warranted despite recent headwinds, and may reverse as operations recover like they did in Q4 2022.

Vital’s EV/EBITDA multiple of 2.2x implies ~72% upside if it were to trade in line with the peer average of 3.8x, which may happen over time with broader market acceptance of operating improvements. Notably, VTLE is cheap vs. comps on trailing 2022 numbers and consensus forward 2023 numbers. This seems unlikely to persist:

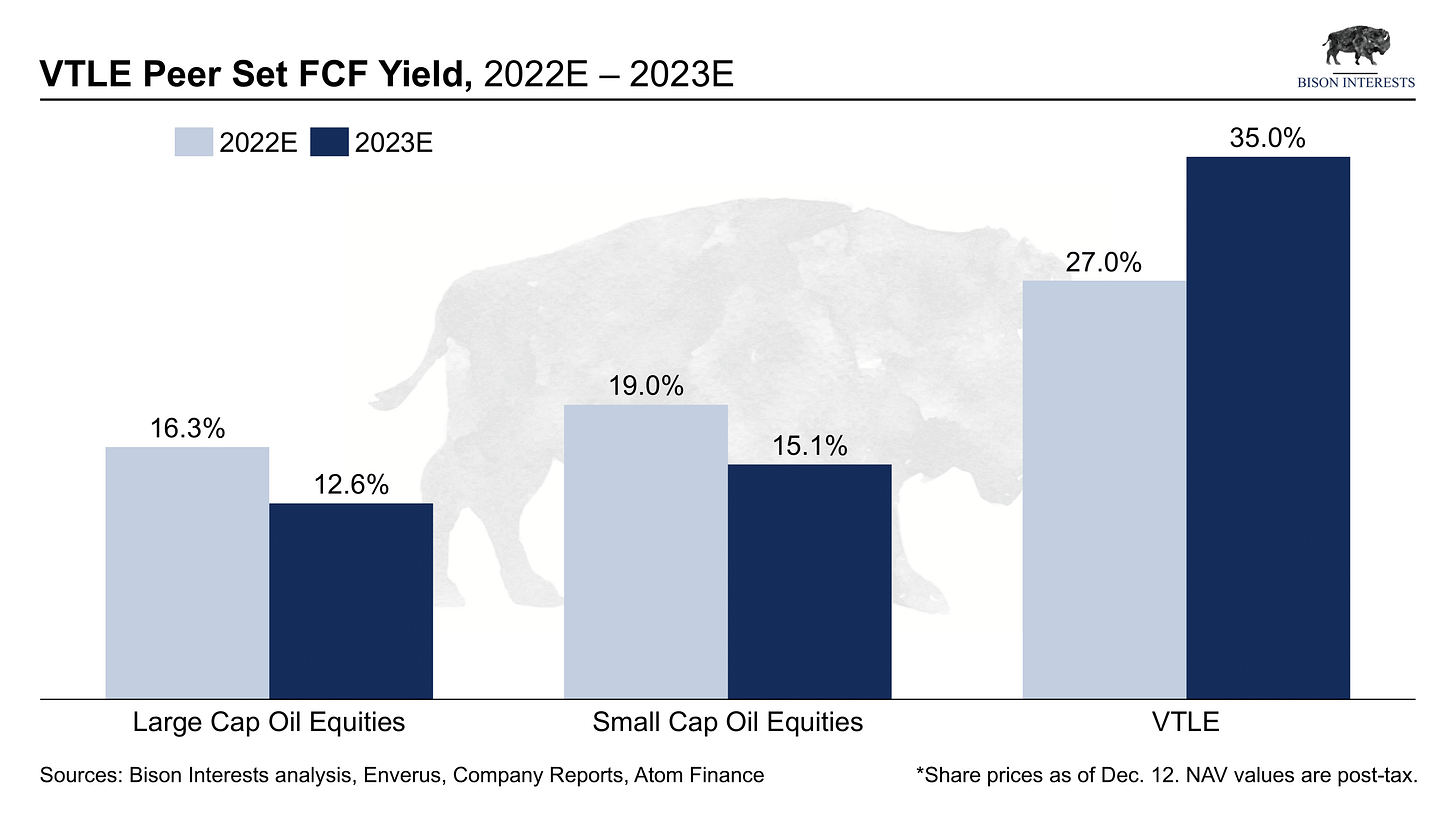

On a free cash flow basis, large cap equities command a slight premium to small caps, which is partially justified by larger inventories, scale, and lower breakeven costs. VTLE’s lower inventories and higher break-even costs may contribute to a valuation discount:

Despite smaller, lower quality inventory, VTLE’s free cash flow yield is projected to increase materially in 2023 as Vital actively buys back shares and retires debt, while both large and small cap peers are projected to become more expensive in consensus estimates. VTLE may have ~130% upside if its free cash flow yield were to trade in line with peers:

Small cap oil and gas equities are trading at a steeper discount to large caps, and once again, VTLE’s valuation is at the low end of the pack. VTLE may have ~130% upside if it were to trade in line with its net asset value at $80 WTI and $3 HH, which are roughly in line with current commodity prices:

And while there is upside to all VTLE’s peers if they were to trade up to their net asset values (NAVs) at current commodity prices, VTLE's current valuation offers significantly more upside:

Debt & Liquidity

Even if commodity prices don’t rise, Vital’s free cash flow is likely to be higher in 2023 as it pays off high interest debt and buys back debt on the open market. Vital’s debt repurchases significantly lower interest payments, unlock free cash flow and are highly accretive to shareholders as they make room for Vital to buy back deeply discounted shares. In 2022, Vital repurchased $285MM of various senior note tranches, with interest rates ranging from 7.750% to 10.125%.

Vital’s liquidity has increased from $550MM to $955MM between February and December of last year, and we estimate Vital reduced net debt and leverage by ~30% and ~40%, respectively, in 2022:

Risks

There is always a risk to Vital’s well performance and production if there are further frack hits on existing North Howard wells. However, this appears unlikely given Vital’s focus on drilling offset wells which are intended to mitigate potential interactions, and it helps that existing long lateral wells are seeing performance improvements versus initial disappointments.

Like all oil and gas producers, Vital is exposed to commodity price risk. If oil prices were to fall substantially and remain low for an extended period, Vital’s free cash flow and stock price could fall from here. However, a meaningful portion of Vital’s production is hedged at favorable oil and gas prices which offers downside protection if commodity prices fall, implying it may outperform peers if this occurs. And there is always the risk that the small cap oil and gas equity valuation discount persists even as fundamentals improve, which means there's a risk VTLE might take longer to re-rate than we expect.

Management

It is important to note that Vital is increasingly focused on ESG and non-commercial measures and activities. This includes the recent rebranding of the company from Laredo to Vital. We are returns oriented, and the costs of these measures seem unjustified and may be increasing the discount VTLE is experiencing in the market. However, as the company pays off debt and increasingly buys back stock, this discount may result in more accretion from share buybacks. And this ESG focus may make a buyout more palatable for larger companies, particularly to pay the premium likely necessary to successfully acquire such a heavily discounted producer.

Conclusion/Takeaways

VTLE has multiple paths to a much higher share price. The most immediate near-term catalyst for VTLE is likely a production “surprise.” Upcoming earnings are likely to reflect the ongoing operational improvements at Vital. These may have been overlooked by the market, as many aren’t familiar with the company or the re-brand and may not have considered the recent presentation.

Another near-term catalyst for VTLE is its rapid paydown of burdensome, high-interest debt. The Modigliani-Miller theorem, a pillar of modern corporate finance, stipulates that there is an optimal level of debt that maximizes the value of the firm’s equity. It follows that for over-levered firms, debt paydown is catalyst for equity revaluation, and we have seen this work in practice with other investments.

Most importantly for value investors, there is an opportunity to buy VTLE at a heavily discounted, seemingly unjustified valuation ahead of broader market realization of improving fundamentals. While Vital has had a turbulent last few quarters the situation has since improved, yet it continues to trade as if further production misses are likely.

If Vital’s valuation does remain low, there is a reasonably high chance it gets bought out by a large cap E&P trading at a higher valuation. Small cap buyouts by large caps have been increasingly popular given this valuation discrepancy, and multiples on deals have been rising:

As Vital’s valuation remains depressed, there is a window of opportunity to purchase an E&P with assets in one of the most economic areas of the US at a bargain price. Vital’s steep discount implies they are likely to outperform peers over time, even if commodity prices don’t rise. Considering Vital’s meaningful free cash flow, they are likely to continue buying back stock and debt to generate a return for shareholders. Vital shares are on sale for now, but perhaps not for long.

Important Disclaimer: Opinions expressed herein by the author are not an investment recommendation and are not meant to be relied upon in investment decisions. The author is not acting in an investment adviser capacity. This is not an investment research report. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC and CSA filings, and consult a qualified investment adviser. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice. The author and funds the author advises may buy or sell shares without any further notice.

The sad thing here is that Josh's comment on it being discounted was entirely right, but the company went ahead and diluted stock to massively since this was posted.

When Josh posted this:

- Market Cap : $949M

- Stock Price: $51.6

- Outstanding Shares: ~16,717M as per Q1'23 results

Today:

- Market Cap: $1.89

- Stock Price: $51.6

- Outstanding Shares: 36,800M as per Yahoo

Most recently they continue to fund more acquisitions (didn't completely understand this - https://investor.vitalenergy.com/news-releases/news-release-details/vital-energy-closes-second-transaction-acquire-additional) - via 879k common stock and 980k of a "2% cumulative mandatorily convertible preferred securities".

As a side note - it is worth mentioning how companies can create shares out of thin air (and as long as those shares aren't sold on the market, and investors aren't spooked) that prop up the market cap and ironically make the stock less investable.

The deep discount simply no longer applies! They are projecting a $350M adjusted FCF for 2024, which is just 18% FCF Yield, in line with the average small cap shown in this report.

But who would believe their FCF? In Q2'22 they projected $560M FCF in FY23, but only got $217.

In Q2'22 they targeted <1.00 Net Debt/EBITDAX, but they're still at 1.09 today targetting only to get it to 1 in FY24

In FY'22 they said they plan to invest $625-675M in the upcoming year, yet did $1.6B in 2023.

Another negative not mentioned is that they're just 47% oil, and gas prices are at a bottom, while producers continue to drill wells in liquid rich areas: https://x.com/Josh_Young_1/status/1770061946672357662?s=20

These guys may be a decent acquisition target, and may have upside if they get acquired - but given management hasn't kept promises in its earnings and is diluting crazily with what I'm not sure is "accretive" acquisitions... is this worth the risk?

This isn't a complete analysis by me, and I very well may be missing something (I hope).

If anything, since the stock price hasn't materially moved since doubling the shares and the market cap has doubled (i.e the underpriced aspect has worsened)... isn't there a great risk of downside here if the market chooses to revert back to its previous valuation?

At this point, one should ask themselves - is it worth staying?

Sources:

- https://finance.yahoo.com/quote/VTLE/

- https://investor.vitalenergy.com/news-releases/news-release-details/vital-energy-reports-first-quarter-2023-financial-and-operating

- https://www.tradingview.com/chart/z1iDOLzD/?symbol=NYSE%3AVTLE

Be careful! there is also Vital Energy inc (VUX.V) https://www.vitalenergyoil.com/

is a public junior oil and gas company based in Calgary, Alberta, focused on conventional crude oil exploration, development and production in Western Canada.